- Bitcoin surged to over $64K after the Fed’s price minimize, exhibiting a 2.8% enhance in 24 hours.

- Analysts warning that regardless of bullish indicators, sure indicators counsel a doable worth reversal forward.

Bitcoin [BTC] has shifted its trajectory from a interval of accumulation and decline to a noticeable restoration part.

Over the previous 24 hours, the asset surged to as excessive as $64,000 earlier than retracing barely to commerce at $63,786 on the time of writing, marking a 2.8% enhance.

This rally comes within the wake of the U.S. Federal Reserve’s announcement of a price minimize, which has triggered constructive market sentiment throughout danger belongings, together with Bitcoin.

Is a reversal forward?

Whereas this worth enhance has sparked optimism, analysts are cautiously analyzing Bitcoin’s fundamentals to find out the sustainability of this rally.

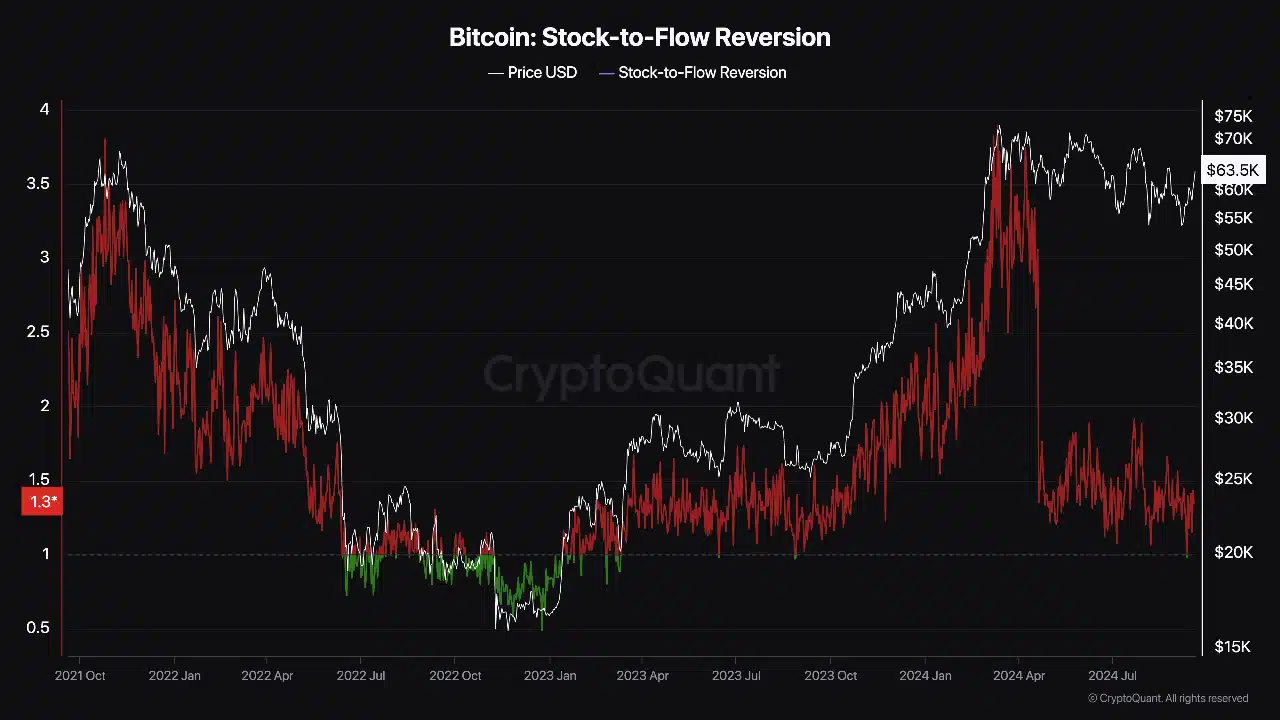

A CryptoQuant analyst, utilizing the pseudonym ‘Darkfost,’ highlighted a possible purple flag. Darkfost pointed to the Inventory-to-Circulate (S2F) reversion chart, signaling a doable reversal.

The S2F mannequin is usually used to forecast Bitcoin’s worth actions by evaluating the availability of recent BTC getting into the market (stream) with the full current provide (inventory).

In keeping with Darkfost, the S2F ratio is at present in a inexperienced zone, signaling a shopping for alternative as Bitcoin touched this threshold and started its restoration.

Nevertheless, the analyst warned that the final time this occurred, in September and June 2023, the asset skilled a major pullback.

This raises whether or not the present rally has sufficient momentum to maintain itself, or if one other retracement is on the horizon.

Bitcoin fundamentals present power

Regardless of considerations of a possible reversal, Bitcoin’s fundamentals are exhibiting indicators of power that will assist additional upward motion.

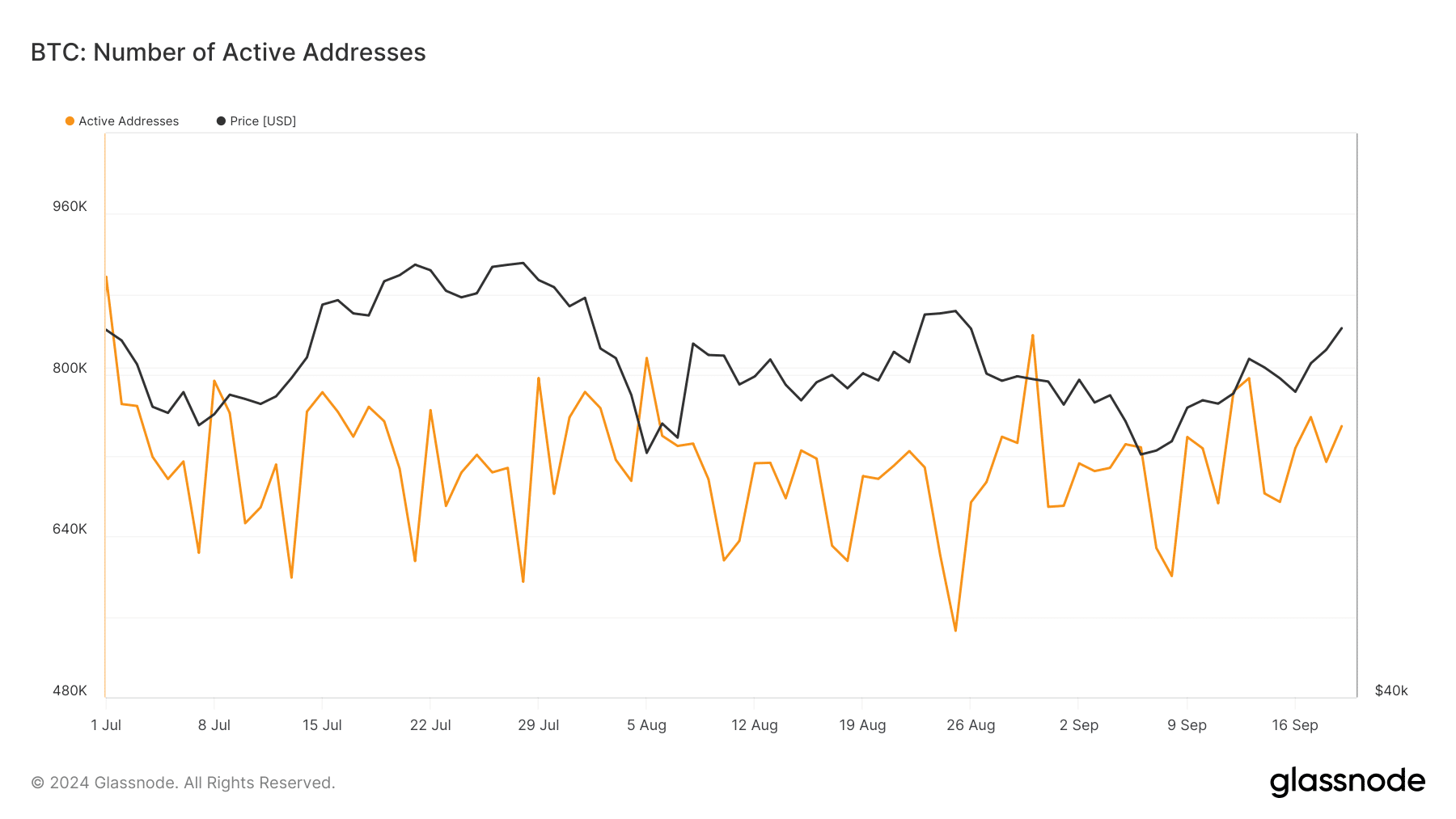

One key metric is the restoration of Bitcoin’s lively addresses, which serves as an indicator of retail curiosity within the asset.

Earlier this month, the variety of lively Bitcoin addresses dipped to round 600,000, information from Glassnode reveals.

Nevertheless, this determine has since climbed to greater than 700,000 as of as we speak. The rise in lively addresses means that extra customers are participating with the community, a constructive signal for demand.

Sometimes, when retail curiosity will increase, it displays rising confidence in Bitcoin, which might bolster worth momentum.

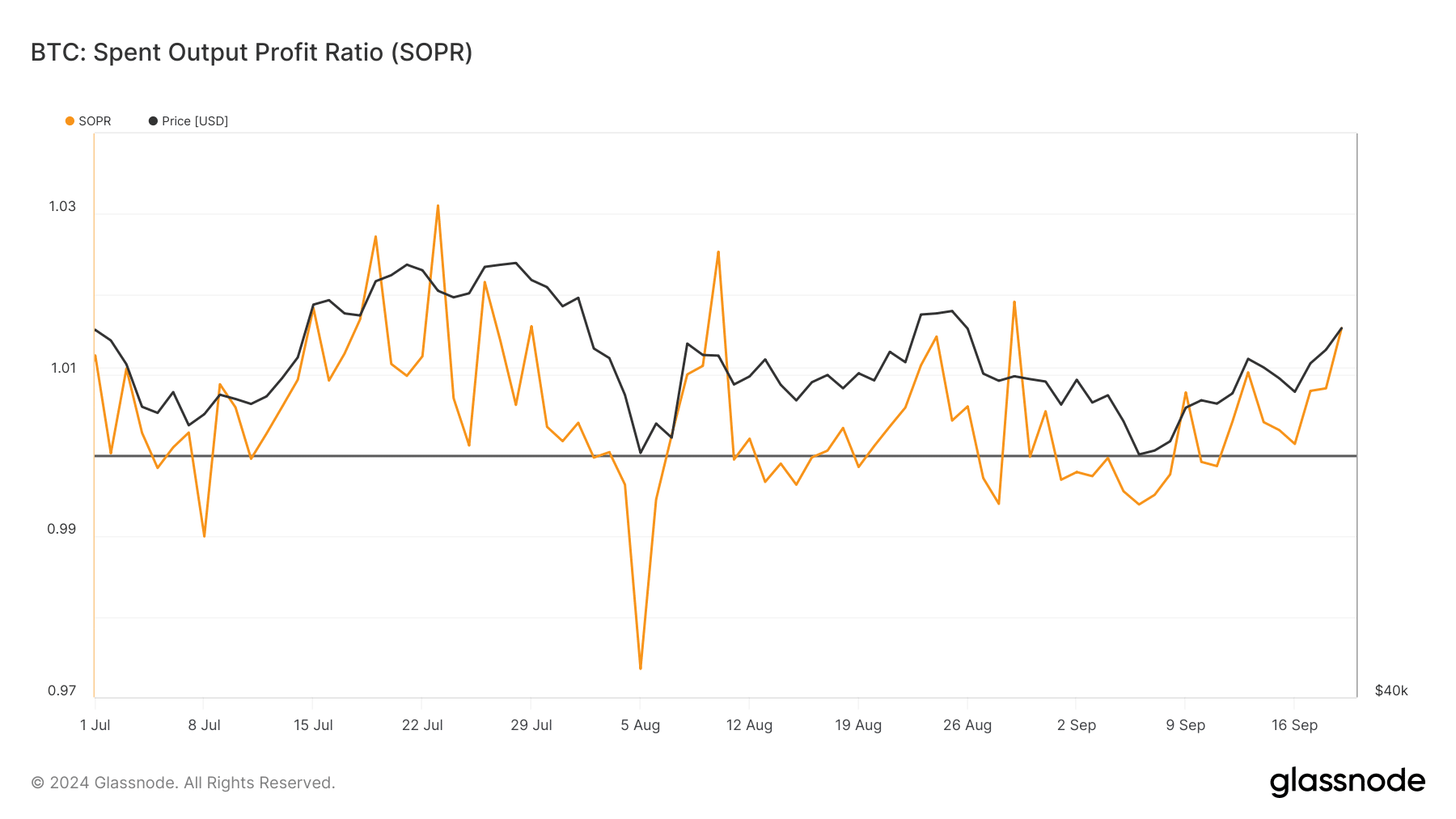

One other vital metric to think about is Bitcoin’s Spent Output Revenue Ratio (SOPR), which measures whether or not traders are promoting their Bitcoin at a revenue or a loss.

A SOPR worth above 1 signifies that holders are promoting at a revenue, whereas a worth beneath 1 suggests they’re promoting at a loss. As of as we speak, Bitcoin’s SOPR sits at 1.01, up from 0.994 in late August.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

This slight enhance signifies that extra traders are realizing earnings on their Bitcoin holdings, signaling a more healthy market sentiment.

A rising SOPR usually aligns with durations of upward worth motion, as traders acquire confidence available in the market and really feel extra inclined to take earnings with out concern of a pointy downturn.