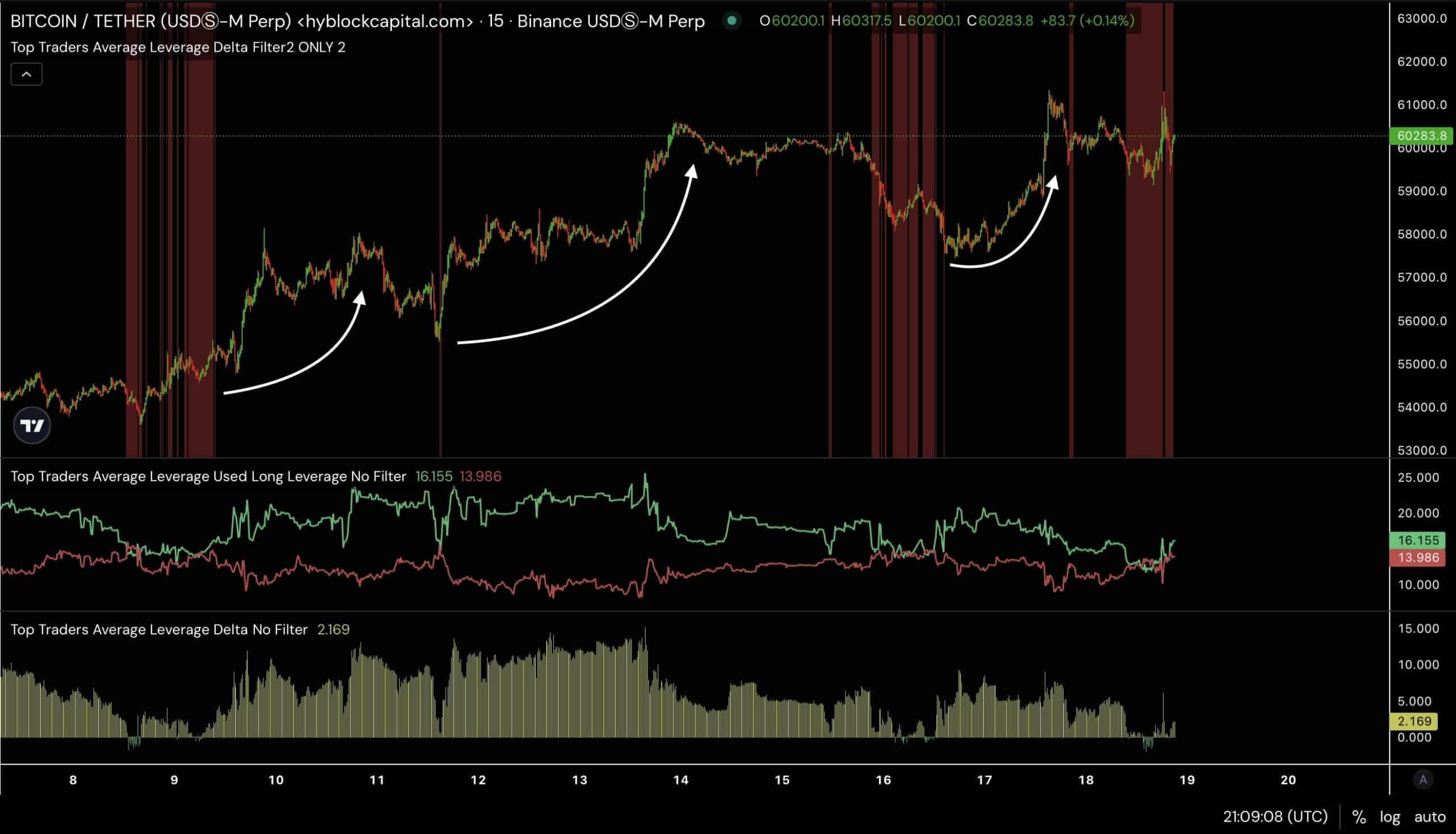

- Bitcoin breaks downtrend channel.

- Bitcoin’s prime merchants common leverage delta falls under 2.

Bitcoin [BTC] continues to realize traction because the crypto markets present indicators of restoration from the current downturn.

Within the hourly timeframe, BTC has lastly damaged out of the downward parallel channel, which has persevered since late July 2024. The vary has lasted for greater than 5o days.

The value motion of BTC/USDT has confirmed this a possible turning level for Bitcoin with a textbook retest. The value motion was forming of upper highs and better lows because it approached the breakout resistance.

Usually, when markets consolidate for prolonged intervals, a parabolic run typically follows. This might set BTC up for a goal of $75k, barely surpassing its all-time excessive.

A rally towards this crucial zone is achievable if market situations stay favorable, as BTC has reclaimed the $62k degree and now targets $65k earlier than doubtlessly reaching $75k in This fall 2024 or early Q1 2025.

May this uptrend push BTC to $75k by the top of the yr? Let’s discover the chances.

High merchants’ Common Leverage Delta indicators…

Traditionally, when the highest merchants’ common leverage delta dips under +2, because it did lately earlier than rising to 2.169, an uptrend has typically adopted.

This provides additional confidence {that a} BTC rally may need begun. The leverage delta for BTC presently sits at +0.49, indicating that the leverage utilized by each longs and shorts is almost equal.

The drop within the prime merchants’ common leverage delta helps the concept BTC/USDT’s breakout from the downward pattern channel may sign the beginning of a bull run.

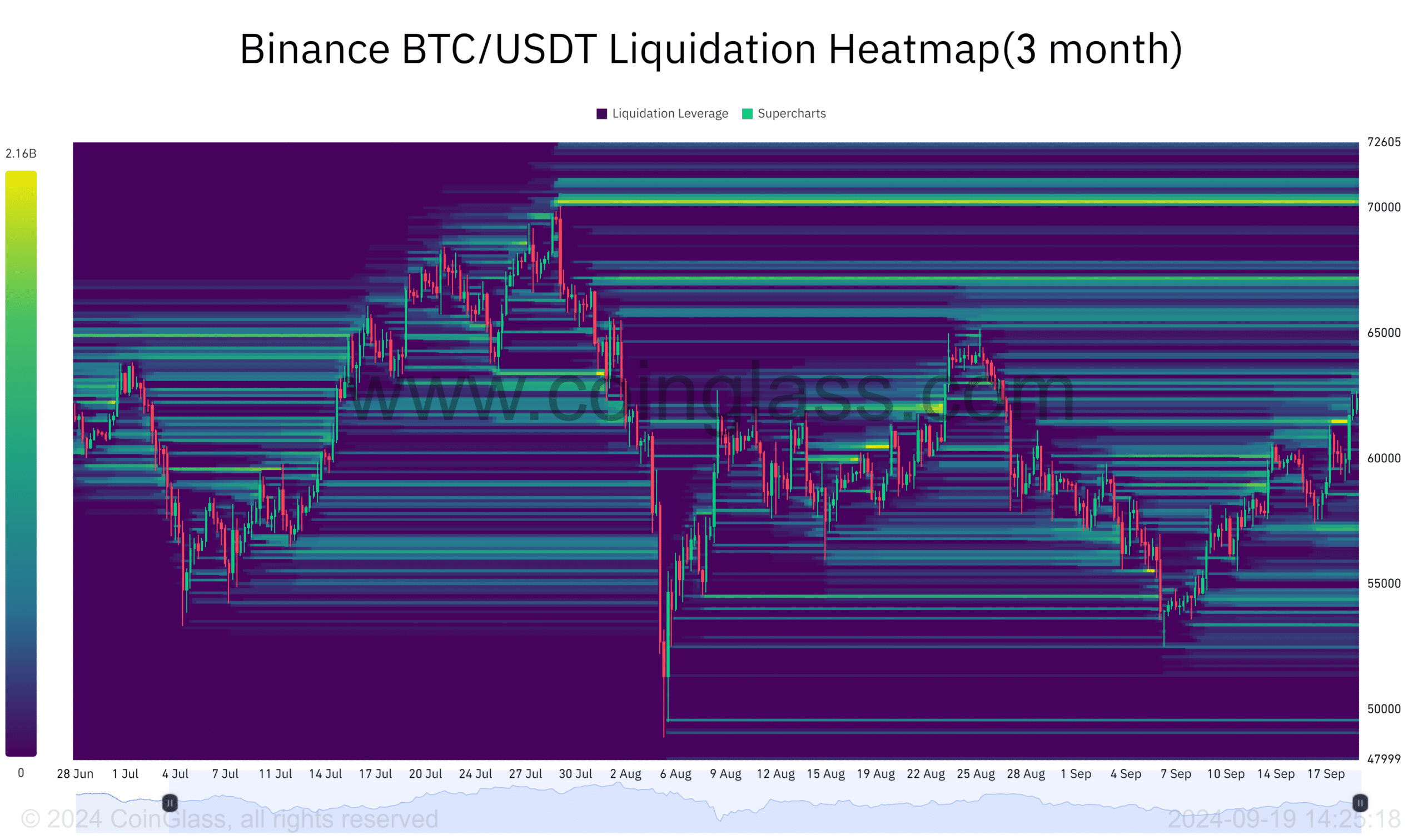

BTC liquidation heatmap

Moreover, Bitcoin’s worth typically strikes towards excessive liquidity zones. Merchants liquidated roughly $179.70 million throughout futures markets when BTC reached $61,498.

This liquidation may gas additional upward motion as worth targets liquidity at larger ranges.

A major liquidity cluster of $730.49 million can be current on the $70182 worth degree, with one other $1.3 billion at $67250.

Supply: Coinglass

BTC may climb larger to succeed in these liquidity ranges, additional fueling its upward momentum, and doubtlessly reaching the $75k goal.

The typical Bitcoin cycle

Moreover, the common Bitcoin cycle traditionally begins 170 days after halving and peaks 480 days afterward.

At present, BTC is 151 days post-halving, which locations it lower than 20 days from the historic begin of a post-halving rally.

This cycle sample provides one other layer of confidence to the potential rally towards $75k, alongside the highest merchants’ common delta signaling a bull run.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Supply: X

The crypto market appears poised for a constructive transfer, pushed by technical indicators and liquidity patterns, which recommend Bitcoin is primed for larger features.