- Bitcoin hit a brand new month-to-month excessive forward of Fed’s resolution.

- BTC whales doubled down on BTC regardless of short-term time period market uncertainty.

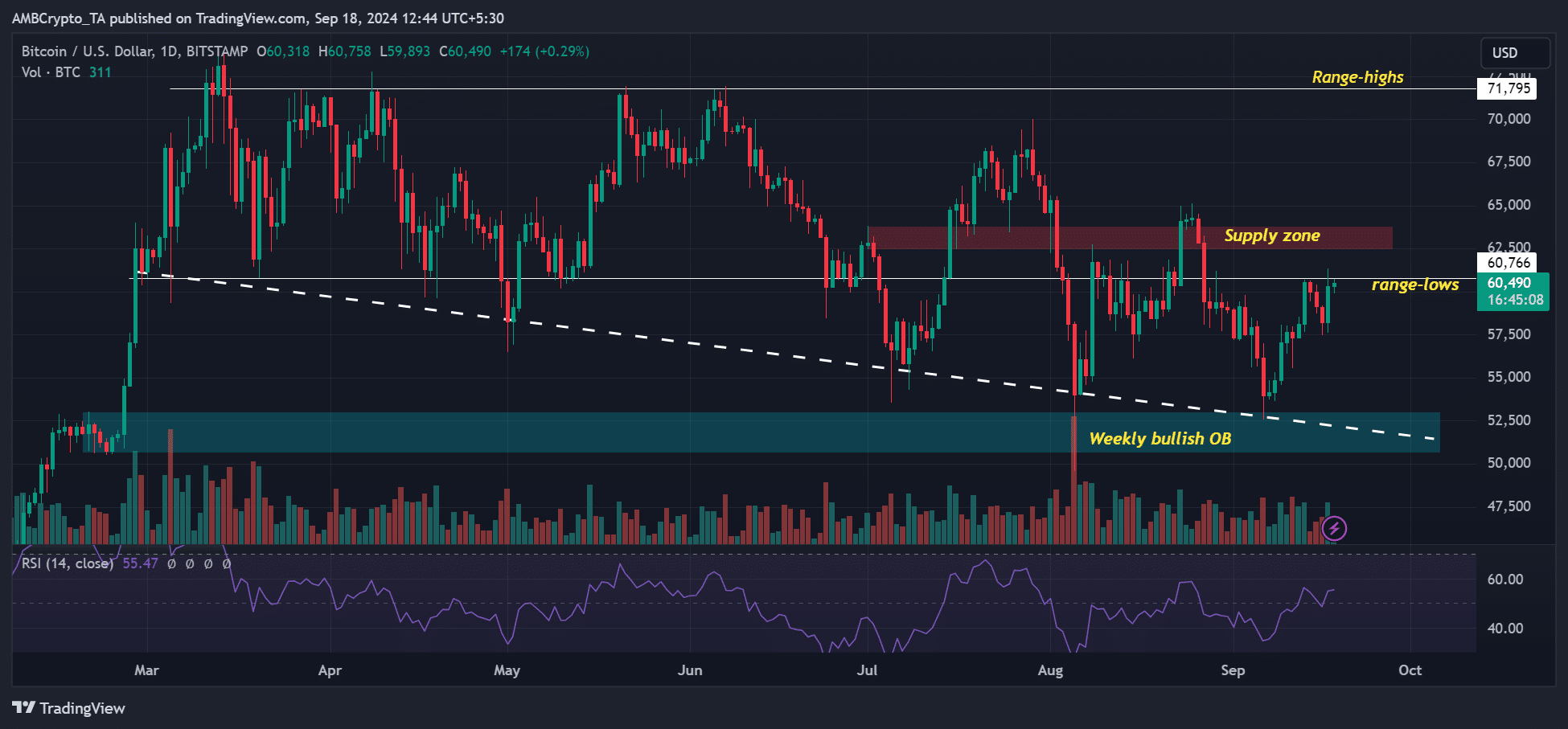

Bitcoin [BTC] hit a brand new month-to-month excessive of $61.3K on the seventeenth of September, only a few hours earlier than the Fed’s resolution on the 18th of September.

BTC has recovered about 14% from its early August lows and was again at its earlier vary lows.

Expectations of a possible Fed rate of interest reduce partly boosted the current BTC uptick. Final week, U.S. financial information confirmed a disinflationary development, whereas the US labor market stagnated.

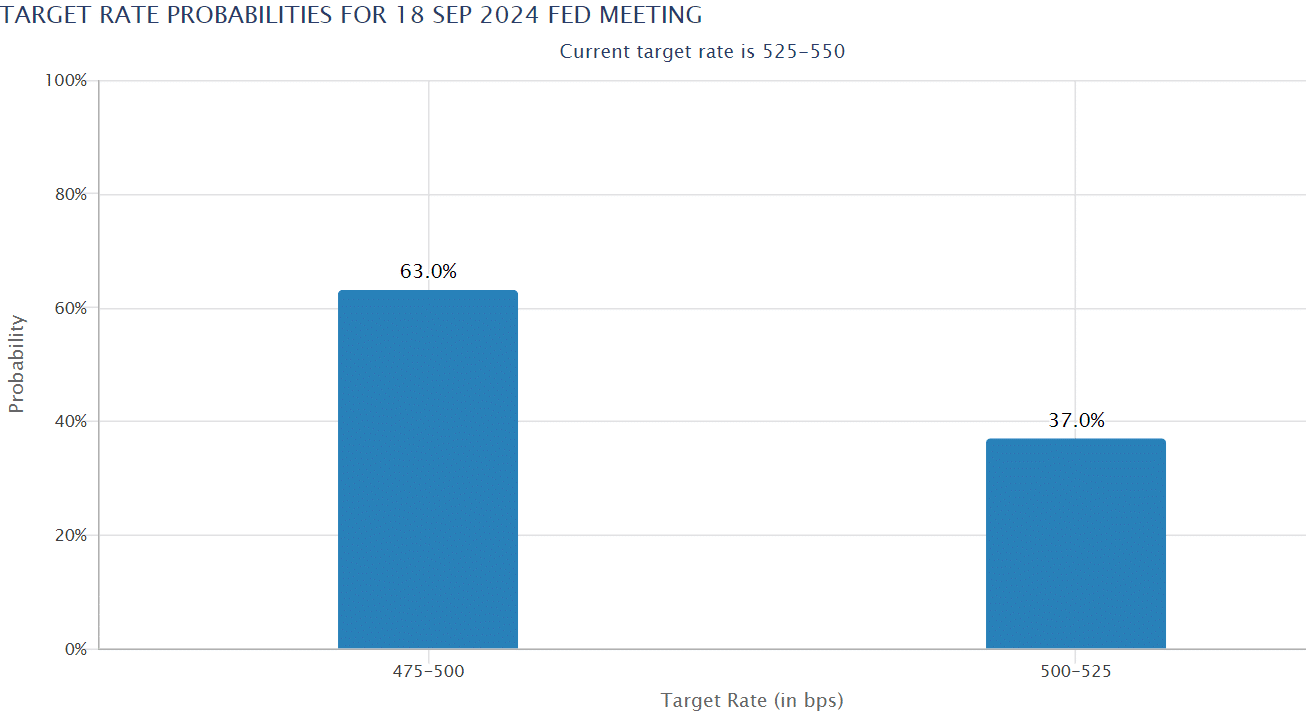

This has tipped some policymakers and U.S. politicians to name for a 0.75% Fed price reduce to cushion the labor markets.

On the time of writing, rate of interest merchants had been pricing a 63% probability of 0.50% (50 bps) Fed price curiosity reduce. This was an enormous U-turn from a 14% probability of a 50 bps price reduce seen every week in the past.

Influence of rate of interest cuts

Market observers agree that Fed rate of interest cuts are structurally bullish for threat markets, given comparatively cheaper credit score.

Nevertheless, some have opined {that a} 50 bps reduce was an aggressive transfer that might sign the Fed’s concern concerning the financial system. This may not be good for threat belongings like crypto within the brief time period.

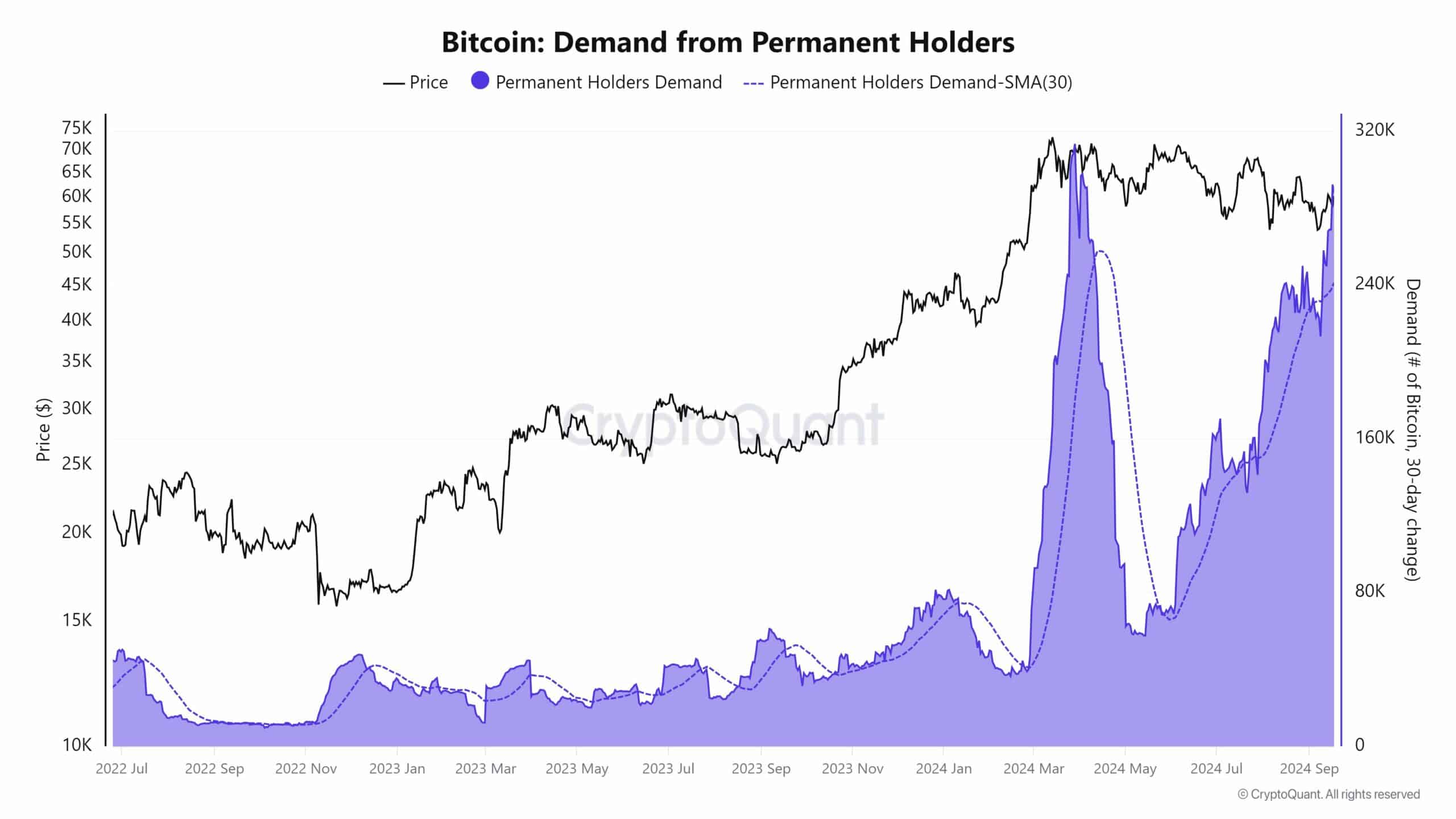

Within the meantime, whales appeared properly positioned for the Fed price resolution. CryptoQuant founder Ki Younger Ju famous BTC whales have aggressively amassed BTC previously six days amid an intensifying provide shock.

Moreover, U.S. spot BTC ETFs confirmed elevated demand, with a $186.76 million internet day by day influx on Tuesday. This bolstered traders’ risk-on mode forward of the Fed resolution.

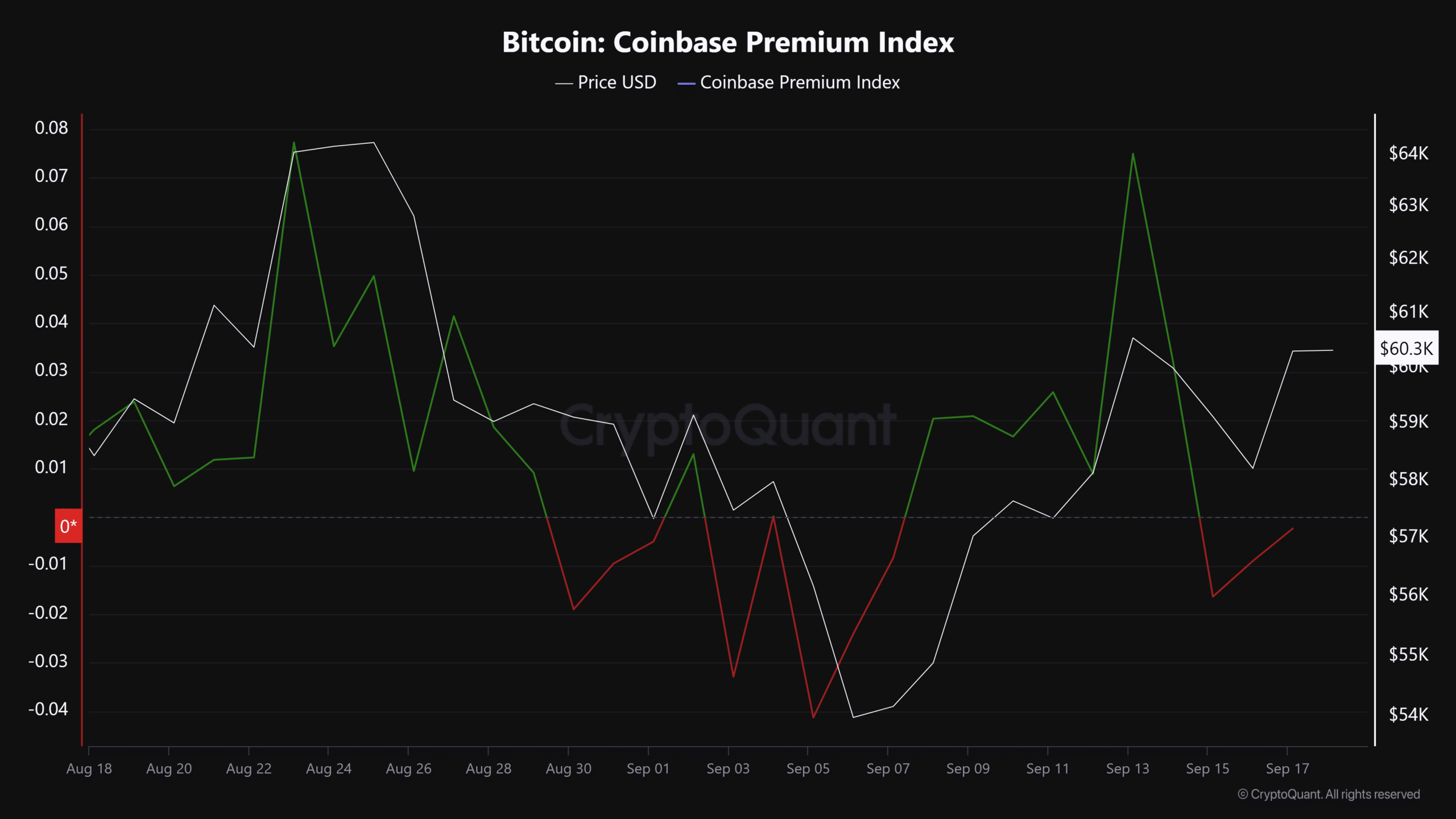

Nevertheless, on the time of writing, the demand from U.S. traders wasn’t too robust, as illustrated by a unfavourable studying from the Coinbase Premium Index.

This demonstrated short-term market uncertainty amid a possible first Fed price reduce since 2020. Whether or not the risk-on strategy seen from U.S. spot BTC ETF traders will persist after the Fed resolution stays to be seen.