- BTC has surged by 9.92% over the previous seven days, however fell once more at press time.

- Regardless of the surge, BTC stays in a bearish market particularly with declining transaction quantity.

During the last week, Bitcoin [BTC] has made a restoration returning to the $60k degree quickly.

Since hitting native lows every week in the past, Bitcoin tried to take care of an upward momentum, however failed because it fell under $60k once more. On the upside, the prevailing market situations have analysts speaking.

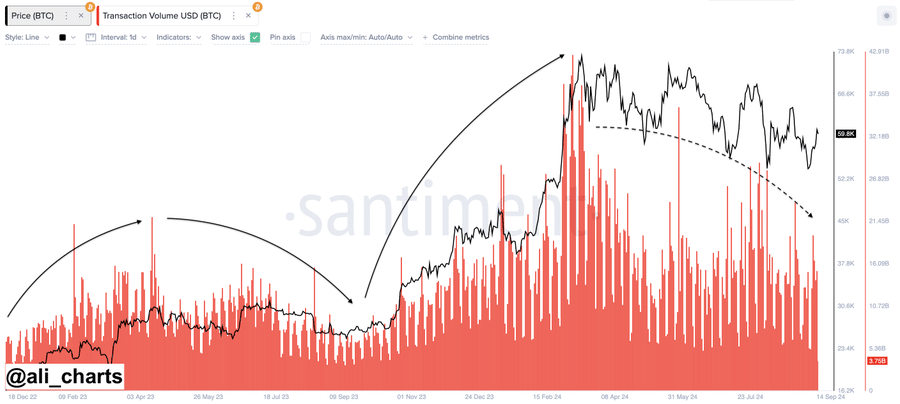

Common crypto analyst Ali Martinez instructed {that a} development reversal was not full citing Bitcoin’s transaction quantity.

Prevailing market sentiment

In his evaluation, Martinez cited the declining buying and selling quantity which suggests a development reversal hasn’t occurred.

In keeping with this evaluation, throughout uptrends, BTC transaction quantity tends to extend and reduce throughout a downtrend. Thus, since, the present situation sees declining buying and selling quantity, the market remains to be in a downtrend.

In context, throughout a worth uptrend, transaction quantity will increase as a result of extra buyers are actively shopping for and promoting leading to greater market exercise.

Thus, a rise in quantity normally confirms the energy of an uptrend, as extra buyers are actively engaged out there.

Subsequently, when markets are in a downtrend, quantity reduces. A decrease quantity suggests fewer market members. This implies that the bearish market sentiment remains to be in play.

As Martinez notes, Bitcoin buying and selling quantity has declined by 58.66% over the previous day. Due to this fact, primarily based on this evaluation, BTC remains to be in a bearish market.

What BTC charts recommend

As famous by Martinez, though BTC has tried to interrupt out, bears are nonetheless dominating the market. Due to this fact, the present market situations might set Bitcoin for a decline.

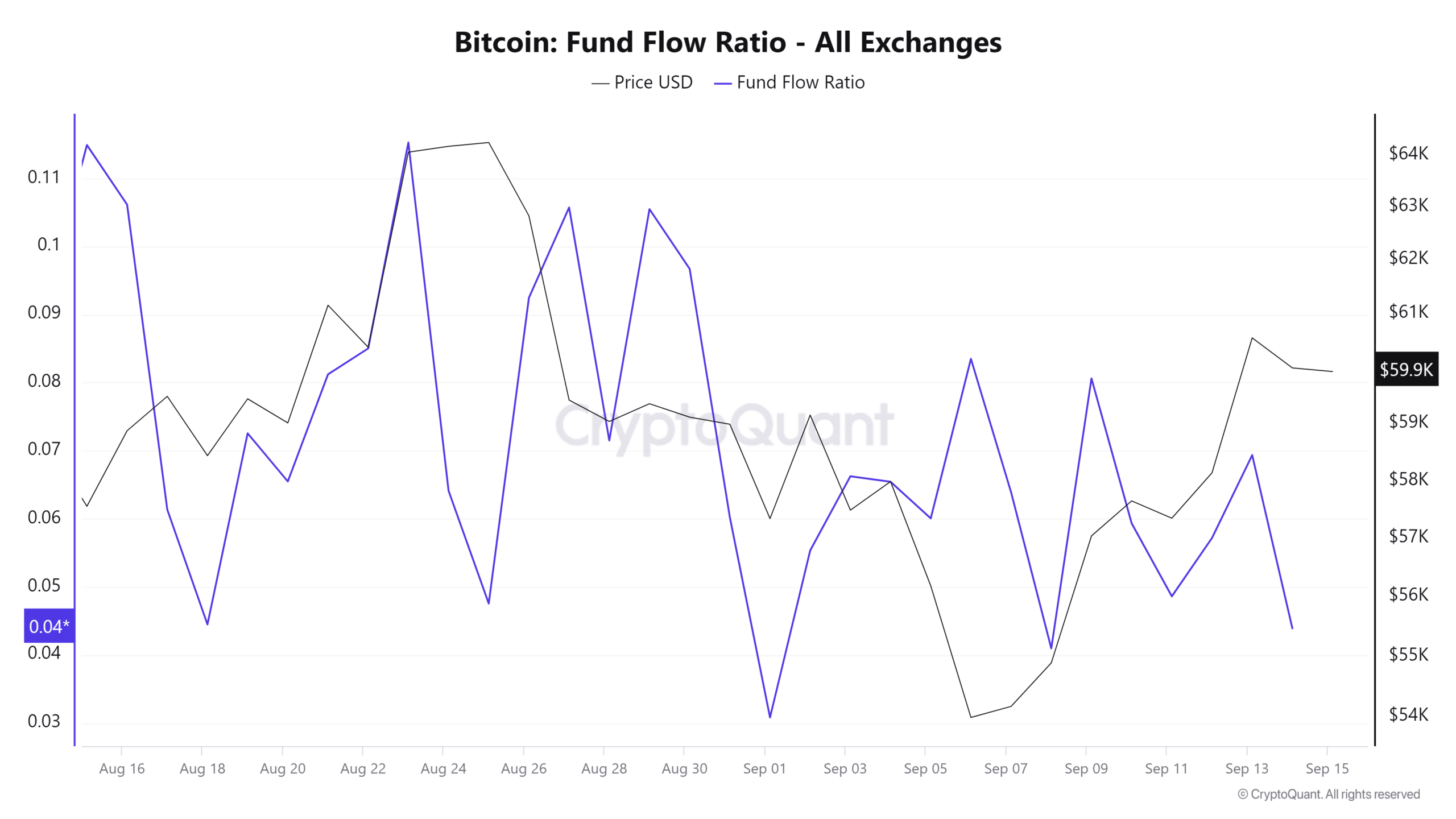

For instance, Bitcoin’s fund movement ratio has declined over the previous week. This means there’s much less shopping for exercise in comparison with promoting which implies few buyers are injecting their funds into the market.

This can be a bearish market sentiment as buyers are closing their positions contributing to downward worth stress.

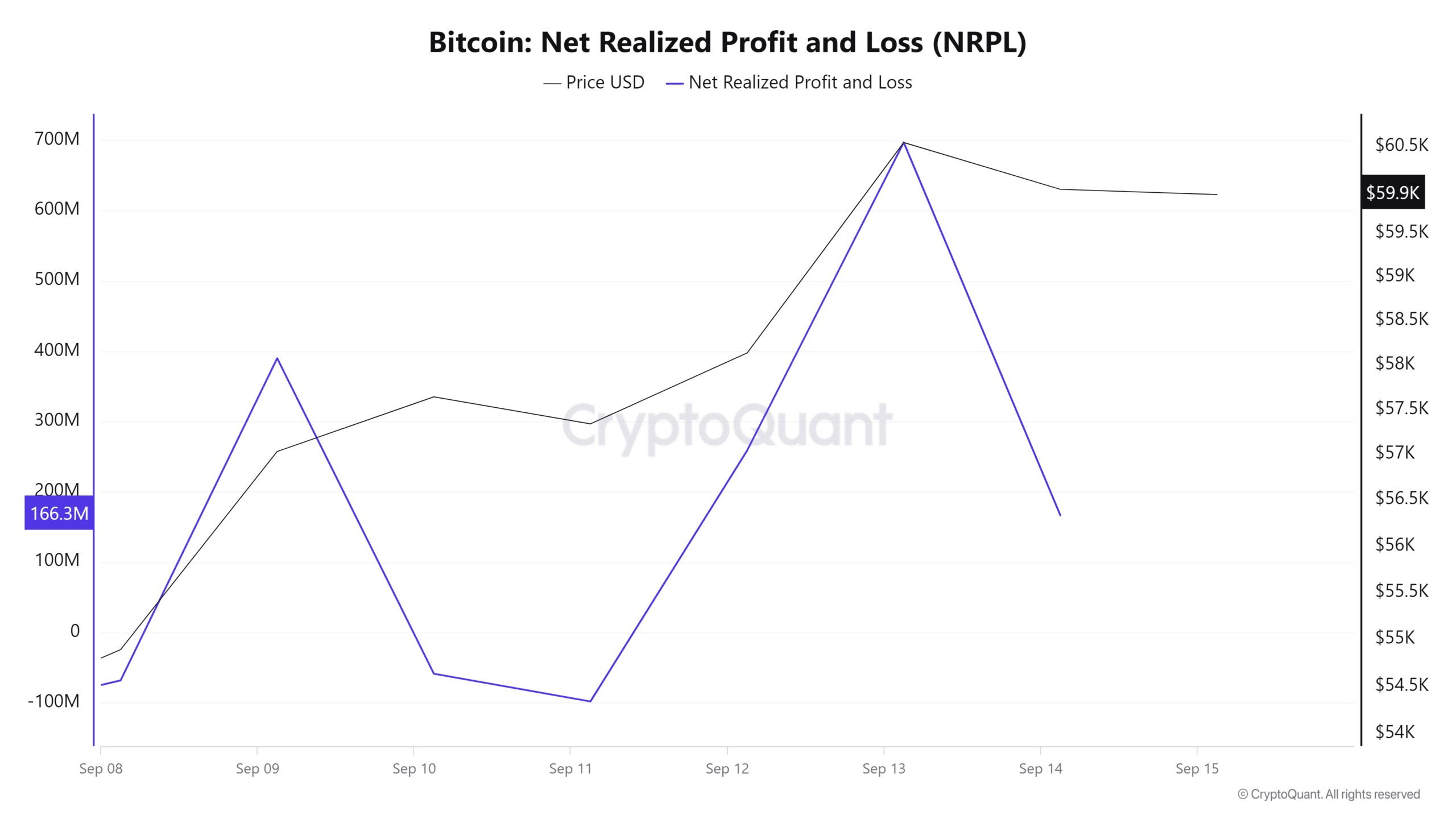

Moreover, Bitcoin’s web realized revenue/loss has declined over the previous 2 days after spiking the earlier days. A decline in NRPL implies buyers are promoting at a loss.

This implies that there’s lowered demand for BTC as fewer consumers are prepared to buy at greater costs or there’s much less buying and selling exercise.

Lastly, Bitcoin’s worth DAA divergence has remained over the past week. A destructive DAA divergence means Bitcoin costs are rising whereas day by day energetic addresses decline.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

This implies that whereas the costs are rising, the elemental utilization of the community is just not catching up. That is bearish as the worth rise is a mere speculative rally.

Merely put, as Martinez notes, Bitcoin remains to be within the bearish development. Thus, if this destructive market sentiment holds, BTC dangers a decline to $57342.