- Bitcoin ETFs noticed inflows after weeks of outflows, signaling a possible market shift.

- Wealth advisors rapidly adopted Bitcoin ETFs, driving important internet flows regardless of restricted institutional participation.

After weeks of steady outflows, Bitcoin [BTC] Trade Traded Funds (ETFs) have lastly proven indicators of restoration.

Between the twenty seventh of August and the sixth of September, BTC ETFs noticed a complete outflow of $1,185.9 million, indicating a difficult part for the asset.

Nonetheless, on the ninth of September, BTC ETFs recorded a internet influx of $28.6 million, signaling a possible shift in market sentiment.

Matt Hougan’s tackle Bitcoin ETF

Commenting on this improvement, Matt Hougan, Chief Funding Officer at Bitwise, famous that wealth advisers are adopting Bitcoin ETFs quickly, reflecting rising confidence within the asset’s future.

In response to a earlier put up by funding researcher Jim Bianco, who provided a contrasting view on BTC ETF adoption, Hougan mentioned,

“Jim is wrong here: Investment advisors are adopting Bitcoin ETFs faster than any new ETF in history.”

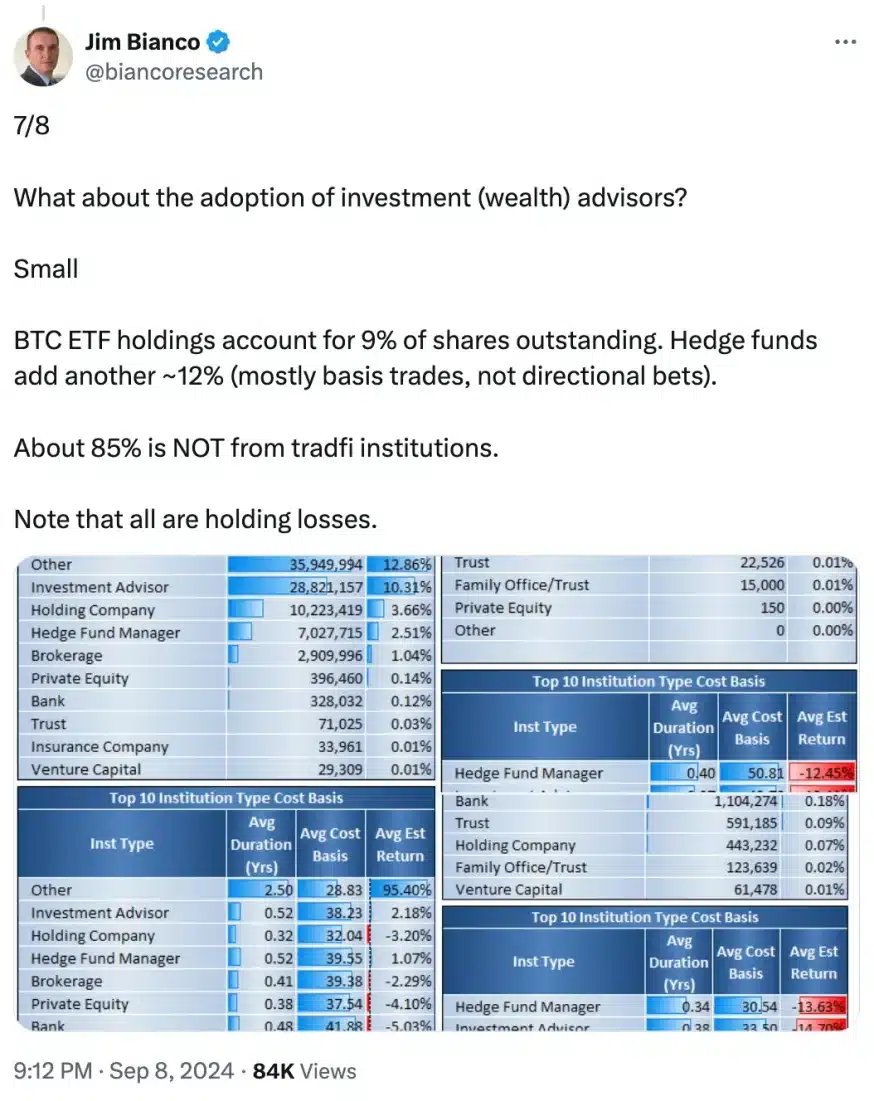

Jim Bianco had identified that conventional monetary establishments usually are not driving the vast majority of Bitcoin ETF inflows, regardless of rising curiosity.

He famous that round 85% of BTC ETF uptake is from non-traditional finance (tradfi) sources, suggesting that whereas wealth advisers are more and more adopting Bitcoin ETFs, institutional participation stays comparatively restricted at this stage.

Is there extra to it?

Contradicting Bianco’s standpoint, Hougan famous,

“Per his [Jim Bianco] table, IBIT has attracted $1.45 billion in net flows from investment advisors. He calls this “small” as a result of it’s a fraction of the $46 billion that has flowed into bitcoin ETFs in whole.”

He added,

“But if you excluded all other flows, and just looked at the $1.45 billion linked to investment advisors, IBIT would be the 2nd fastest-growing ETF launched this year (excluding other BTC ETFs). Out of 300+ launches!”

Hougan additional highlighted that the one ETF surpassing IBIT when it comes to belongings is KLMT, an ESG (Environmental, Social, Governance) ETF.

Nonetheless, KLMT’s massive asset measurement ($2 billion) is deceptive as a result of it was funded by a single investor, not by means of widespread market adoption.

Regardless of this important seeding, KLMT has very low buying and selling exercise, averaging simply 250 shares per day, and no adoption from funding advisors.

IBIT’s progress price

In distinction, IBIT’s progress, whereas smaller, is pushed by a broader base of funding advisors, making its enlargement extra natural and important within the broader ETF market.

Including to his clarification Hougan mentioned,

“The truth is that investment advisors are adopting bitcoin ETFs faster than any other ETF in history. It is just that their historic flows are overshadowed by the even-more-historic purchases of other investors.”

Contradicting Bianco’s assertion he additional highlighted,

“It is accurate to say that investment managers represent a small fraction of buyers of bitcoin ETFs. But it is not accurate to say that investment manager purchases of bitcoin ETFs are “small.”

Bitcoin’s value motion

In the meantime, up to now 24 hours, BTC skilled a notable 3.61% enhance, pushing its value to $56,873 as per CoinMarketCap.

This rise is encouraging, as BTC was confined to a decent buying and selling vary over the weekend.

There now seems to be potential for Bitcoin to interrupt above the $56K threshold. Additionally, the MACD line is approaching the sign line, hinting at a doable bullish crossover.

Nonetheless, the RSI, presently at 45 and working parallel to the impartial line, signifies {that a} bearish momentum stays current, signaling cautious optimism transferring ahead.