- Bitcoin’s buying and selling quantity soared by 37.72% as costs hiked by 1.48% in 24 hours.

- Three whales accrued 2814 BTC value $157.3 million.

During the last months, the crypto market has skilled excessive volatility. Amidst this, Bitcoin [BTC], the most important cryptocurrency, has suffered essentially the most. Over the previous 30 days, BTC has dropped by 9.14%.

As of this writing, BTC was buying and selling at $55182. This marked a 1.48% improve during the last 24 hours. On the identical interval, Bitcoin’s buying and selling quantity has surged by 37.72% to $22.6 billion.

Additionally, its market cap elevated by 1.47% to $1.09 Trillion.

Prior to those beneficial properties, the crypto was experiencing a sustained decline, dropping by 5% over the previous week.

This market dip has created a conducive setting for big holders to purchase the dip. When costs decline, whales are likely to accumulate, hoping to promote for revenue.

Inasmuch, Lookonchain has revealed how whales have turned to accumulation through the dip.

Whales shopping for the dip

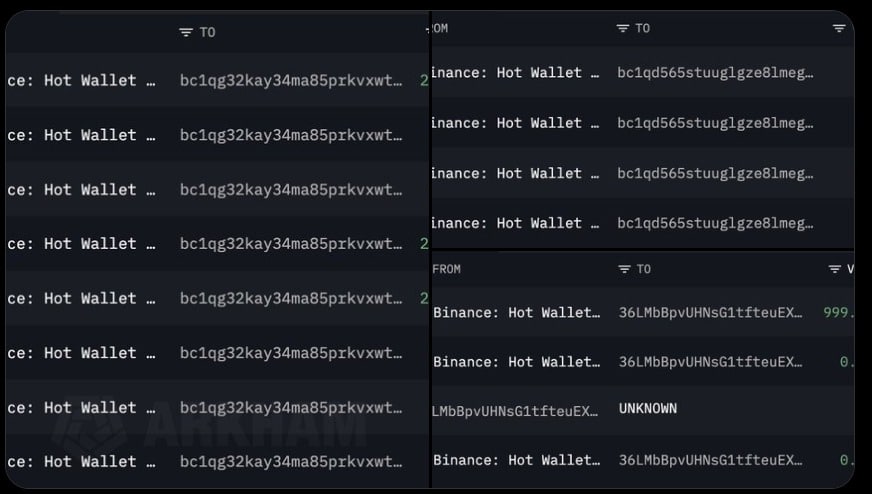

Of their report, Lookonchain has uncovered whale accumulation actions. Based on the report, three whales have turned to purchase the dip by accumulating 2814 Bitcoins value $157.3 million because the 1st of September 2024.

Via its X (previously Twitter) web page, Lookonchain reported that,

“Whales are accumulating $BTC after the market drop! Since Sept 1, 3 whales have accumulated ~2,814 $BTC($157.3M) from #Binance at an average price of $55,887.”

For context, whale shopping for throughout market downturns alerts confidence within the asset’s long-term confidence.

When markets are underperforming, whales use it as accumulating alternative at decrease costs, anticipating future beneficial properties.

This encourages different traders to enter the market, thus stabilizing the market and reversing the pattern.

What Bitcoin’s charts counsel

As famous by Lookonchain, whale actions have elevated for the previous week.

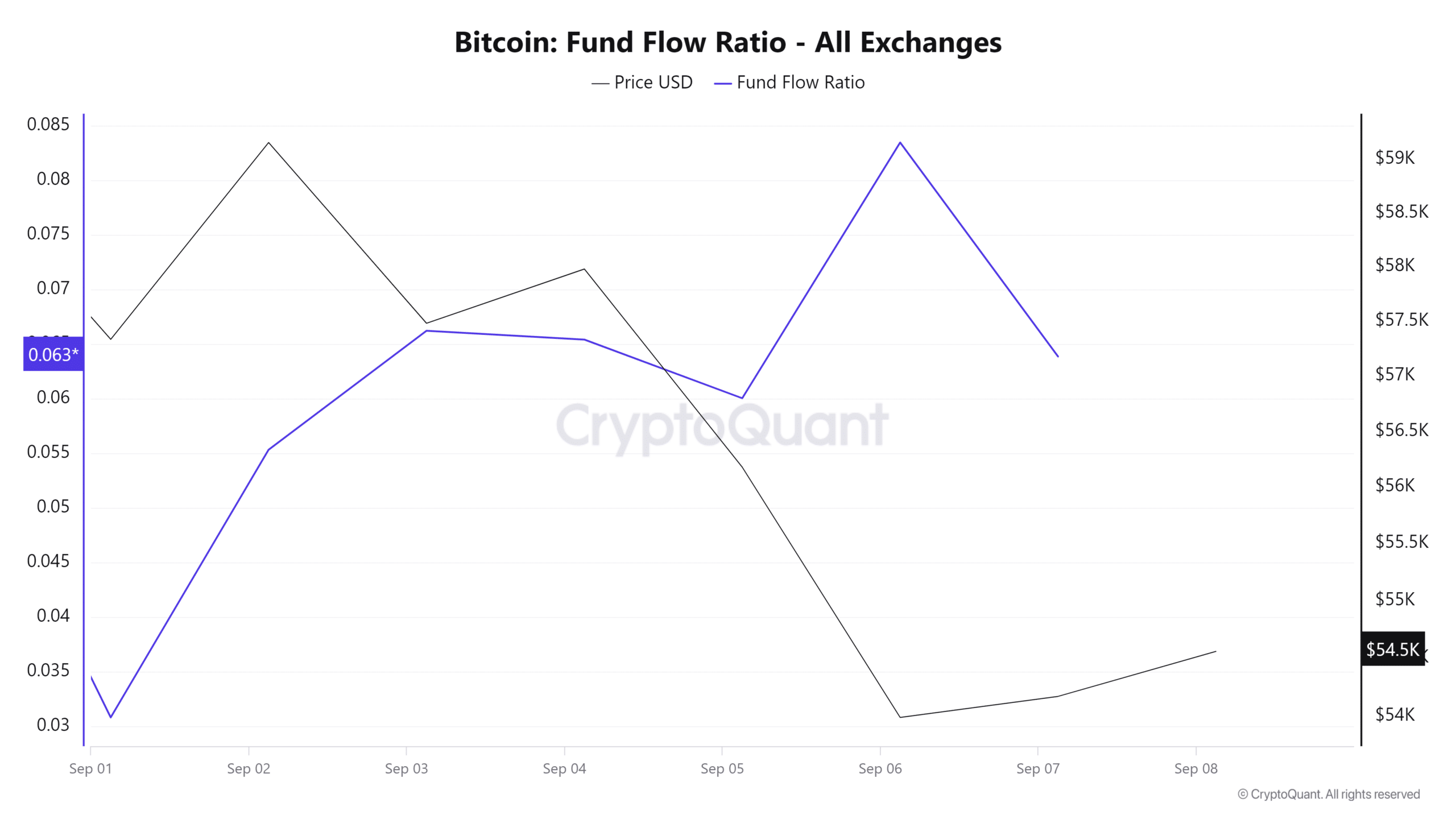

That is additional supported by the reducing fund circulate ratio

. Based on Cryptoquant, the Fund circulate ratio has declined from 0.08 to 0.04 at press time, suggesting that whales had been accumulating property off exchanges — a bullish sign.

This indicated investor confidence in Bitcoin’s future prospects.

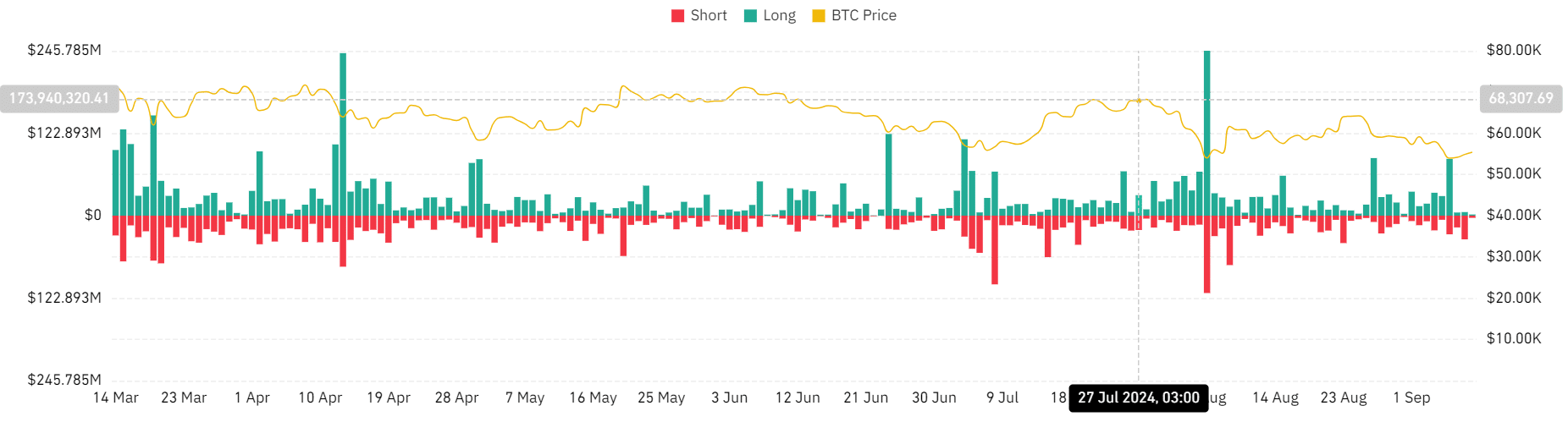

Moreover, short-position liquidation surged to $38.5 million over the previous three days, whereas long-position liquidation declined to $7.3 million.

Thus, these betting towards the market had been pressured out of their positions, whereas lengthy place holders had been prepared to pay a premium to carry their commerce.

Such a situation means that the markets had been rising, with these betting on downturn being liquidated.

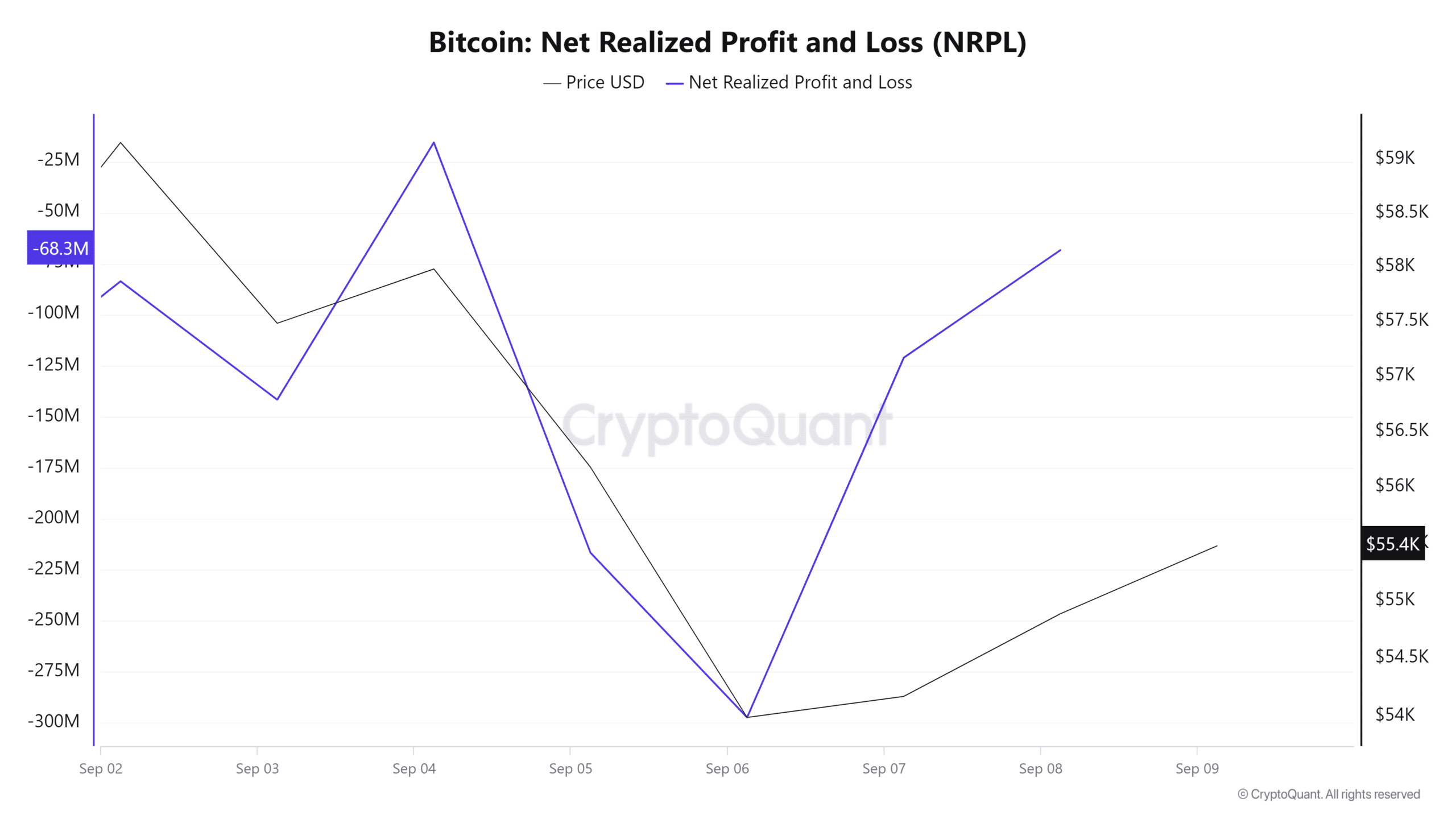

Lastly, Bitcoin’s Internet realized revenue and loss has lowered from -297.2 million to -68.3 million at press time. Whereas the NRPL was nonetheless damaging, it lowered drastically, suggesting that consumers are coming into.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

This accumulation from whales or establishments helps in stabilizing the market by shopping for exercise.

Due to this fact, primarily based on elevated shopping for exercise arising from whale exercise, BTC is well-positioned for additional beneficial properties. If the present market sentiment persists, the BTC pattern will reverse and hit $58272.