- Bitcoin’s 2019 conduct repeats itself, because of its traders.

- Analysts divided on a post-halving rally in 2024 and the possible worth set off.

It’s 5 months after the halving occasion, and Bitcoin [BTC]‘s historic parabolic rally stays elusive.

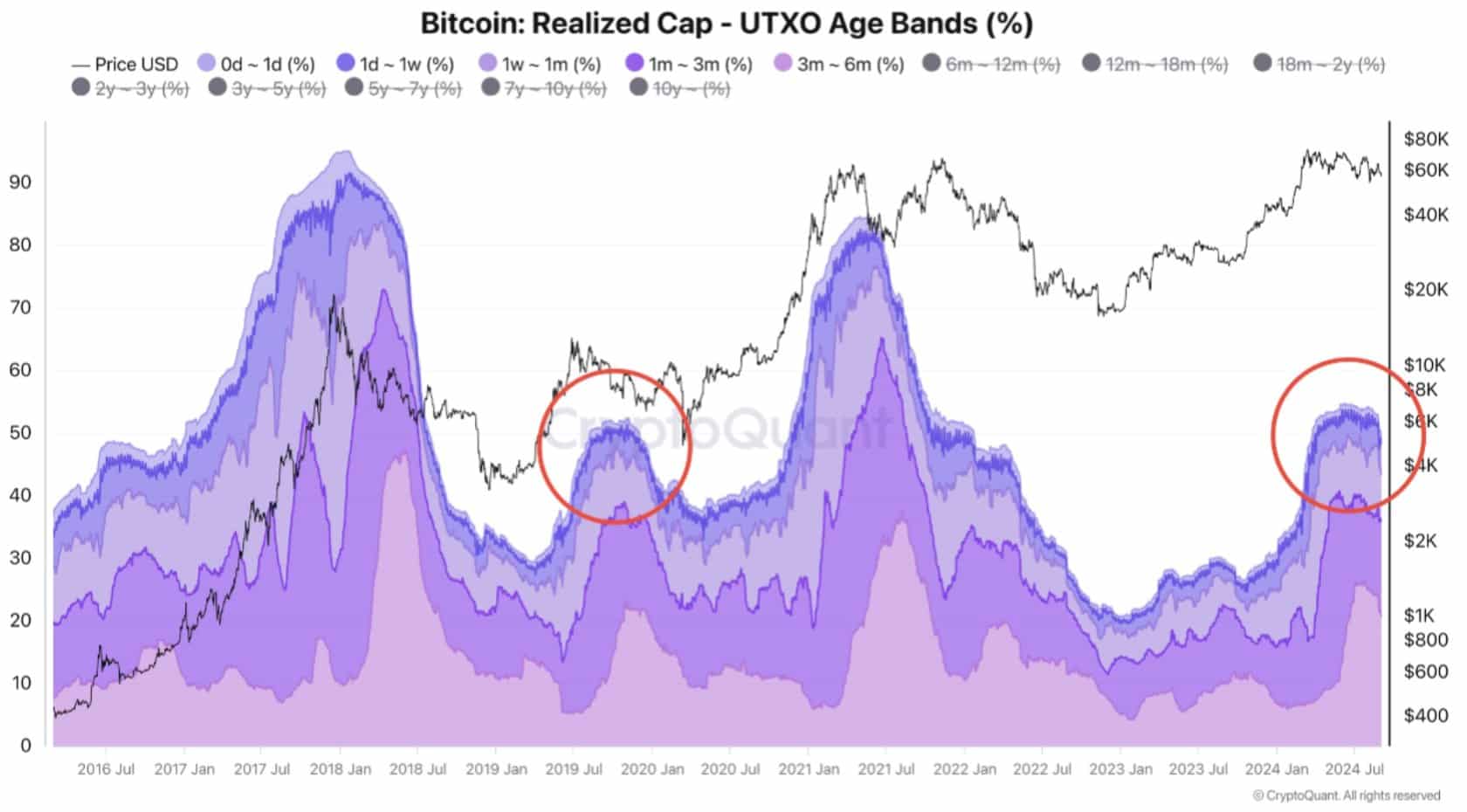

Nonetheless, in keeping with CryptoQuant, the halving rally may nonetheless be in play, particularly as present short-term BTC traders mirrored 2019 conduct.

In line with the knowledge, BTC rallied 490 days after new traders peaked across the 2019 halving occasion, and an analogous sample was taking part in out.

“Currently, we can observe a small peak in UTXOs under six months, which resembles a similar structure seen in 2019 (red circle).”

Combined views on post-halving BTC rally

For context, UTXO (unspent transaction output) gives insights about BTC holders and, by extension, their conduct primarily based on age bands. The above knowledge tracked those that held BTC for lower than six months (new customers).

Nonetheless, the UTXO declined after BTC peaked in March, which the information attributed to new traders’ possible exit because of losses.

However, per the evaluation report, BTC may solely see a large rally if the variety of new BTC traders will increase.

“Historically, the influx of capital from new investors has been a critical condition for Bitcoin’s price increases.”

Each 2019 and 2024 had been BTC halving years. Nonetheless, the historic worth rally occurred in 2020 after the halving occasion. Will historical past repeat?

Some, like famend analyst Peter Brandt, claimed that BTC may not hit a brand new all-time excessive after stagnating for too lengthy in comparison with earlier cycles.

Nonetheless, Outlier Ventures’ Jasper De Maere cautioned that BTC and digital property have matured and that the halving occasion was inconsequential to cost in 2024.

“It’s time for founders and investors trying to time the market to focus on more significant macroeconomic drivers rather than relying on the four-year cycle.”

On his half, James Straten believed that the latest 34% drawdown to $49k was regular within the bull run and that the post-halving rally was nonetheless possible.

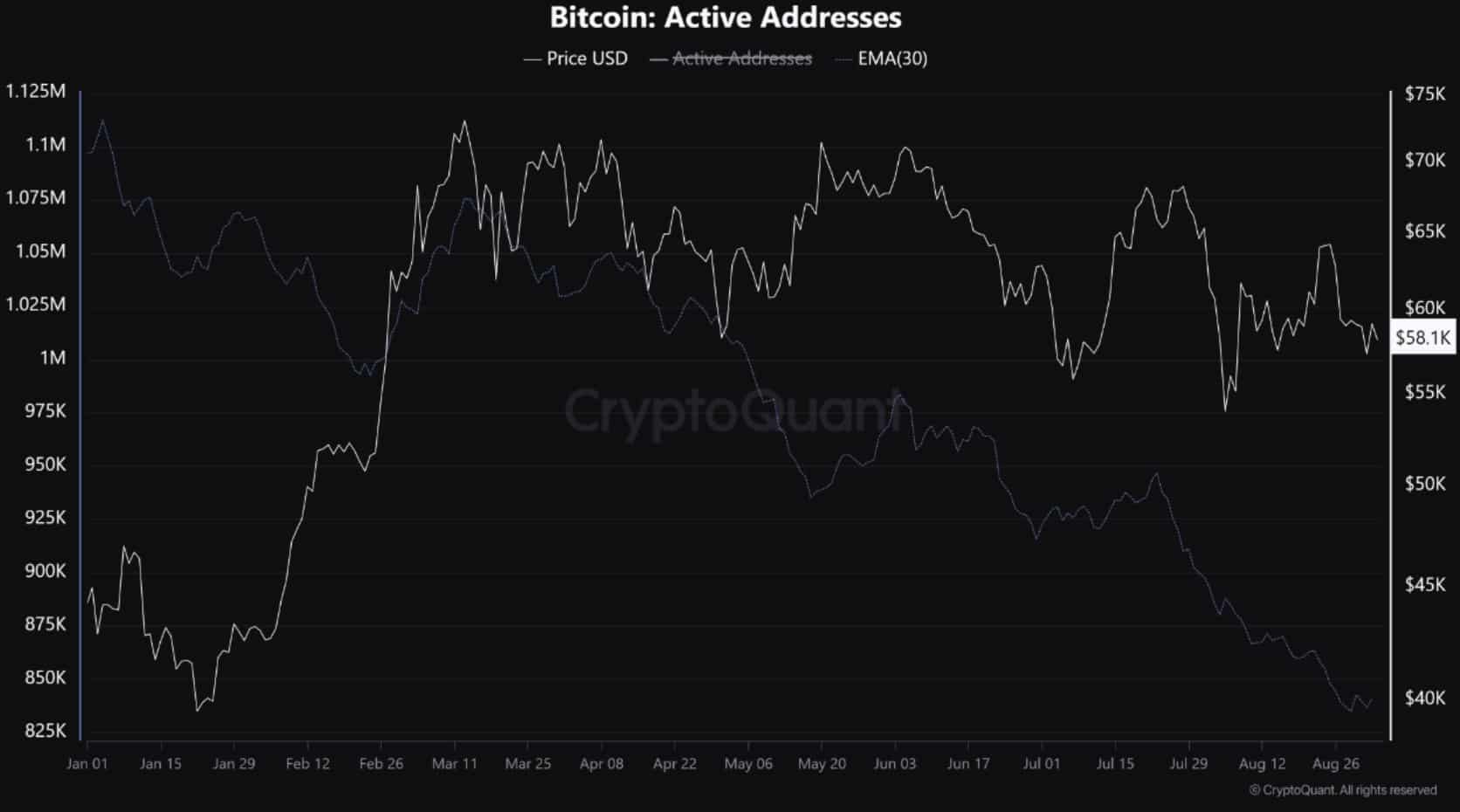

That stated, BTC community exercise contracted additional as energetic addresses hit a report low in 2024 and will additional drag the worth because of muted curiosity within the digital asset.

“Active addresses on the #Bitcoin network hit new lows in 2024, reaching the same level as 3 years ago, when the price of BTC was quoted at around $45,000.”

Whether or not the anticipated constructive macro entrance amid a probable Fed price minimize will set off the post-halving rally stays to be seen.

In the meantime, BTC was valued at $56.7k at press time and has been under $60k because the starting of September.