- Bitcoin bear market has consolidated its value inside a particular vary, jeopardizing the bulls’ possibilities for a rebound.

- If this dominance continues, BTC may drop to $40K. What are the percentages?

Bitcoin [BTC] was buying and selling above $57K at press time, an important stage for a possible rebound. If bulls handle to defend this place, BTC might rally in direction of the $68K resistance.

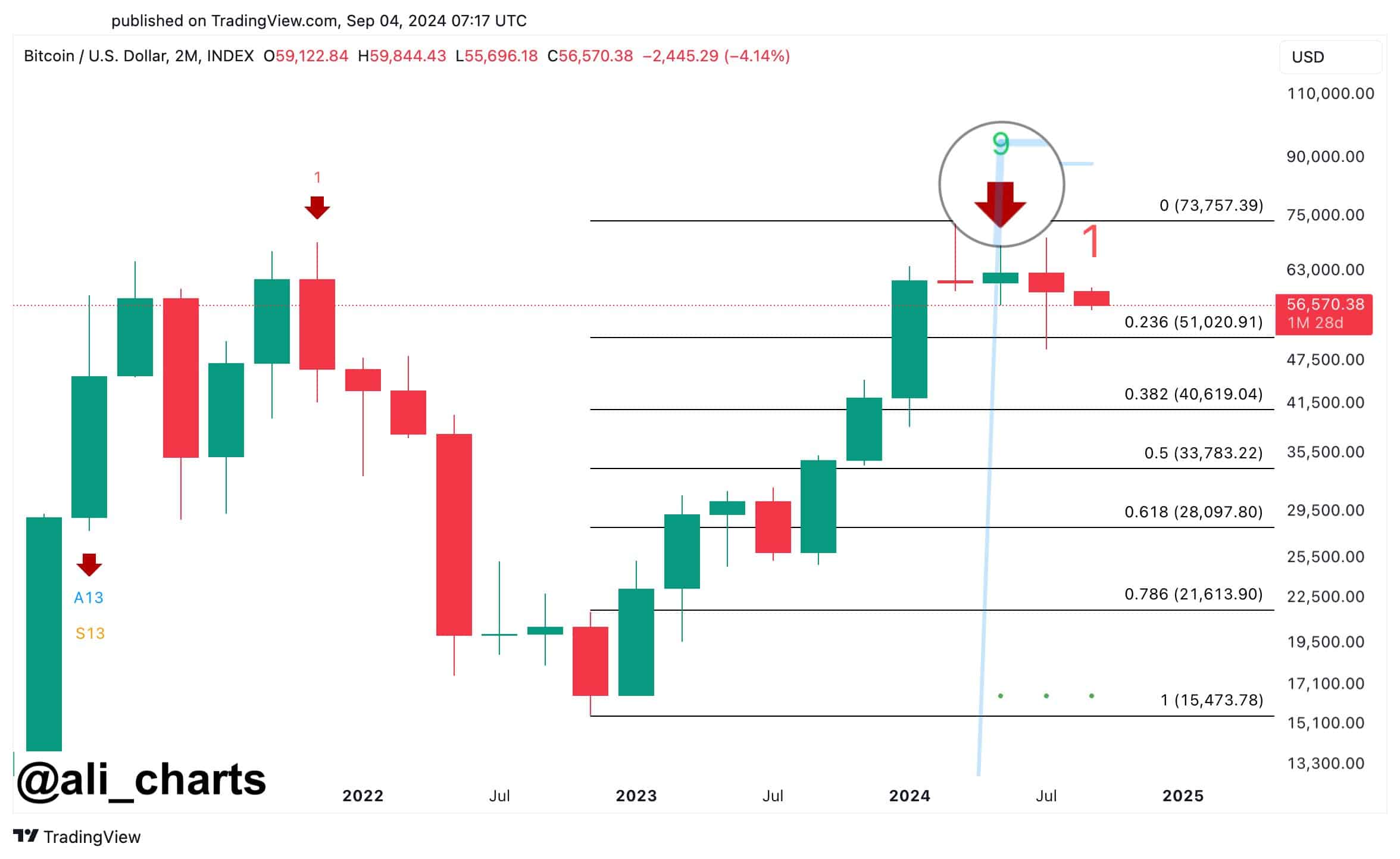

Nevertheless, if the Bitcoin bear market takes management and BTC loses the $55K help, a decline to $50K-$51K is possible. If this help fails, BTC might expertise a deeper drop towards $40K.

Traditionally, September has been Bitcoin’s most bearish month, with solely 4 optimistic years out of the previous 13. Will this month observe the development, or can bulls flip it round?

BTC faces unsure bearish outlook

Including to the uncertainty, analysts are warning that the Bitcoin bear market might regain management.

The TD sequential indicator on the Bitcoin 2-month chart is exhibiting a promote sign, suggesting a possible drop. If BTC falls beneath $51,000, it’d slide to $40,600 – a state of affairs bulls would wish to keep away from.

To stop this, it’s essential to take care of the $57K help stage. AMBCrypto believes that assuaging overcrowding in leveraged positions is vital.

In easy phrases, a ten% discount in open curiosity might assist forestall sudden, sharp value actions.

Furthermore, with much less open curiosity, the market may stabilize, probably leading to a bear pullback or a bullish swing. So, is a drop coming?

Bitcoin bear market reigns supreme

Moreover, the Bitcoin bear market has outperformed the bulls at the beginning of September, retaining the value throughout the $59K – $57K vary.

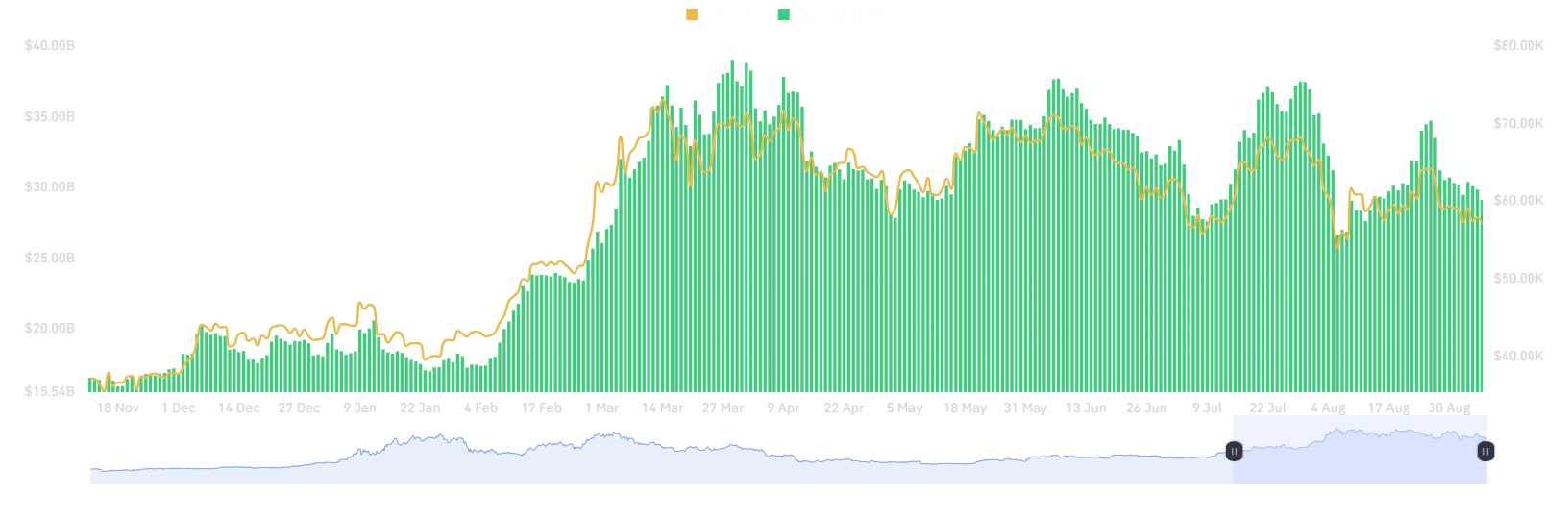

In line with AMBCrypto’s evaluation, on the twenty sixth of August, when BTC examined the $64K ceiling, OI stood at round $34.72 billion. Since then, each BTC and OI have dropped considerably, suggesting that future merchants have aggressively locked in income.

Nevertheless, approaching a zone with important OI once more might improve volatility. As contributors close to breakeven, if many exit, it could gradual momentum and push BTC costs decrease.

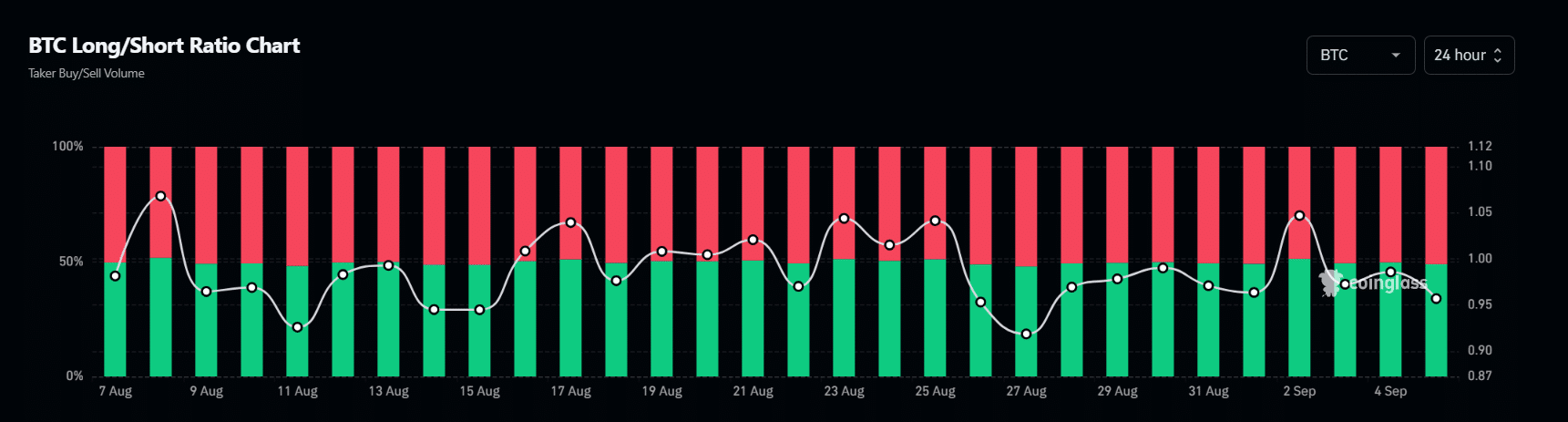

Furthermore, shorts have been dominating longs for the previous three days. As of now, shorts are nonetheless outperforming longs, making up 52% of the market.

If the Bitcoin bear market takes management and BTC assessments the $56,572 value vary, about $45 million in 100x leverage positions may very well be liquidated, doubtlessly pushing the value nearer to $51K.

Conversely, if BTC strikes nearer to $57,400, round $67 million in brief positions may very well be liquidated.

General, excessive OI with shorts dominating the derivatives panorama might favor the Bitcoin bear market. Due to this fact, sustaining the $56K – $57K help stage is essential for a possible breakout – What are the percentages?

Bitcoin establishments face bear menace

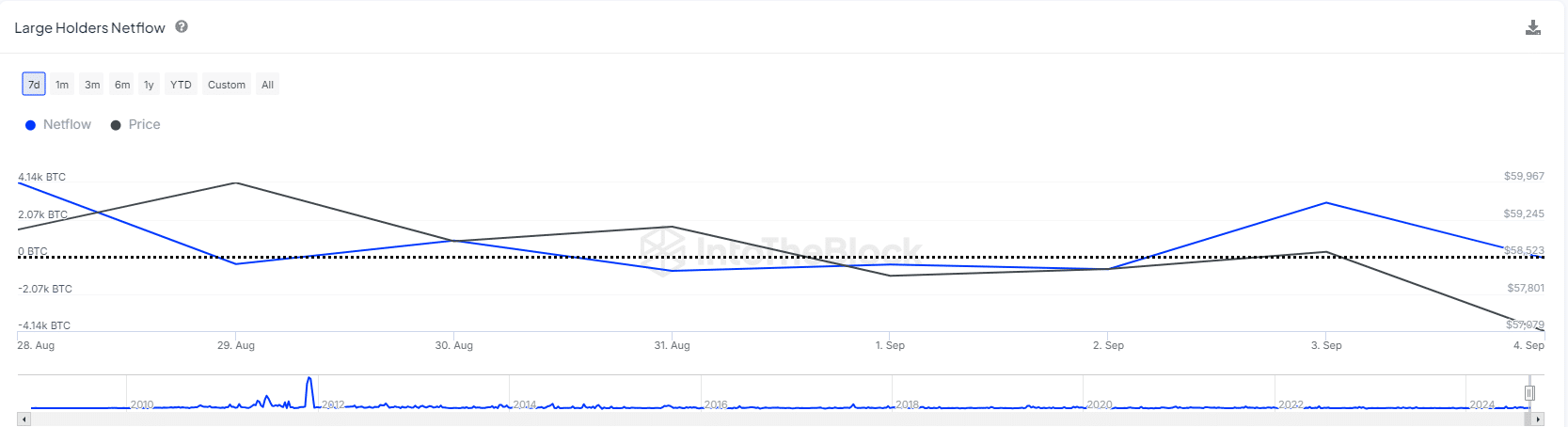

It seems establishments are promoting BTC. Because the twenty sixth of August, crypto asset administration firm Ceffu has deposited 3,063 BTC, value $182 million into Binance. Actually, on the third September, a major optimistic web movement triggered BTC to drop by 3%.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

This chart suggests an absence of optimism amongst massive holders. In line with AMBCrypto, if this development continues, it might set off market panic.

To defend the $57K help and goal $68K, long-term holders should keep away from a promoting spree. In any other case, with the shorts dominating, BTC may fall to $51K and doubtlessly beneath $40K.