- Metric revealed that Bitcoin was overvalued.

- A value correction would possibly carry BTC right down to $61k once more.

After going close to $65k, Bitcoin [BTC] as soon as once more turned bearish because the king of cryptos’ every day chart turned pink. Whereas that occurred, short-term holders continued to promote their holdings. Does this imply a development reversal or a continued value drop? Let’s discover out.

Is promoting strain rising on Bitcoin?

The king coin’s value elevated by greater than 8% final week. The uptick allowed bulls to push the coin in the direction of $65k on the twenty fourth of August.

Nonetheless, issues took a u-turn within the final 24 hours as BTC’s value dipped marginally. In accordance with CoinMarketCap, on the time of writing, Bitcoin was buying and selling at $63,816.53 with a market capitalization of over $1.28 trillion.

Within the meantime, intoTheBlock posted a tweet revealing an attention-grabbing sample. As per the tweet, essential info may be obtained by maintaining a tally of short-term merchants’ balances.

Traditionally, surges within the metric have commonly coincided with market tops and bottoms, offering helpful cues for timing the market.

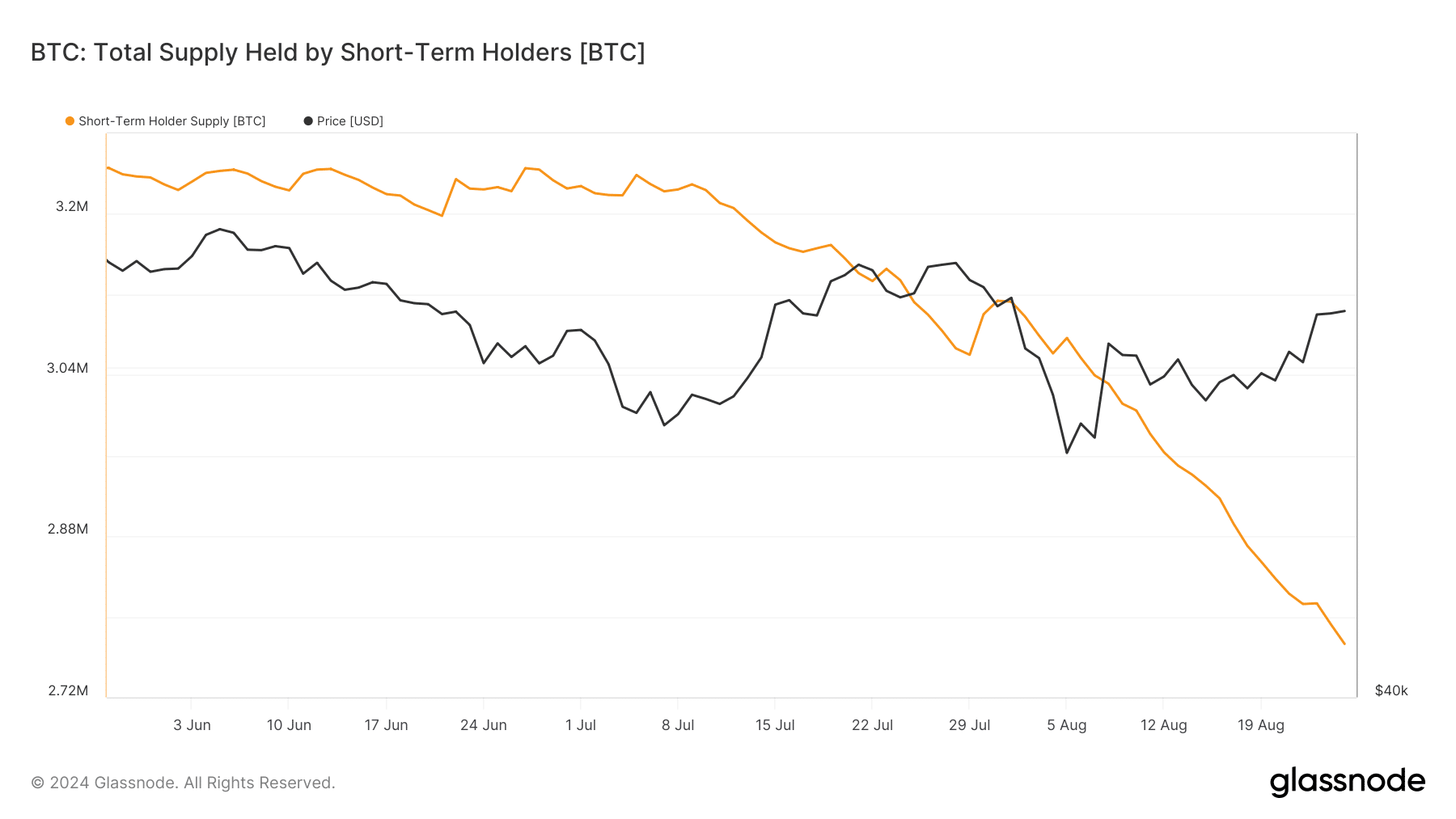

AMBCrypto then checked Glassnode’s knowledge to learn how STHs had been behaving. As per our evaluation, the STHs had been on a promoting spree. This was evident from the large drop within the whole provide held by short-term holders over the past three months.

BTC’s street forward

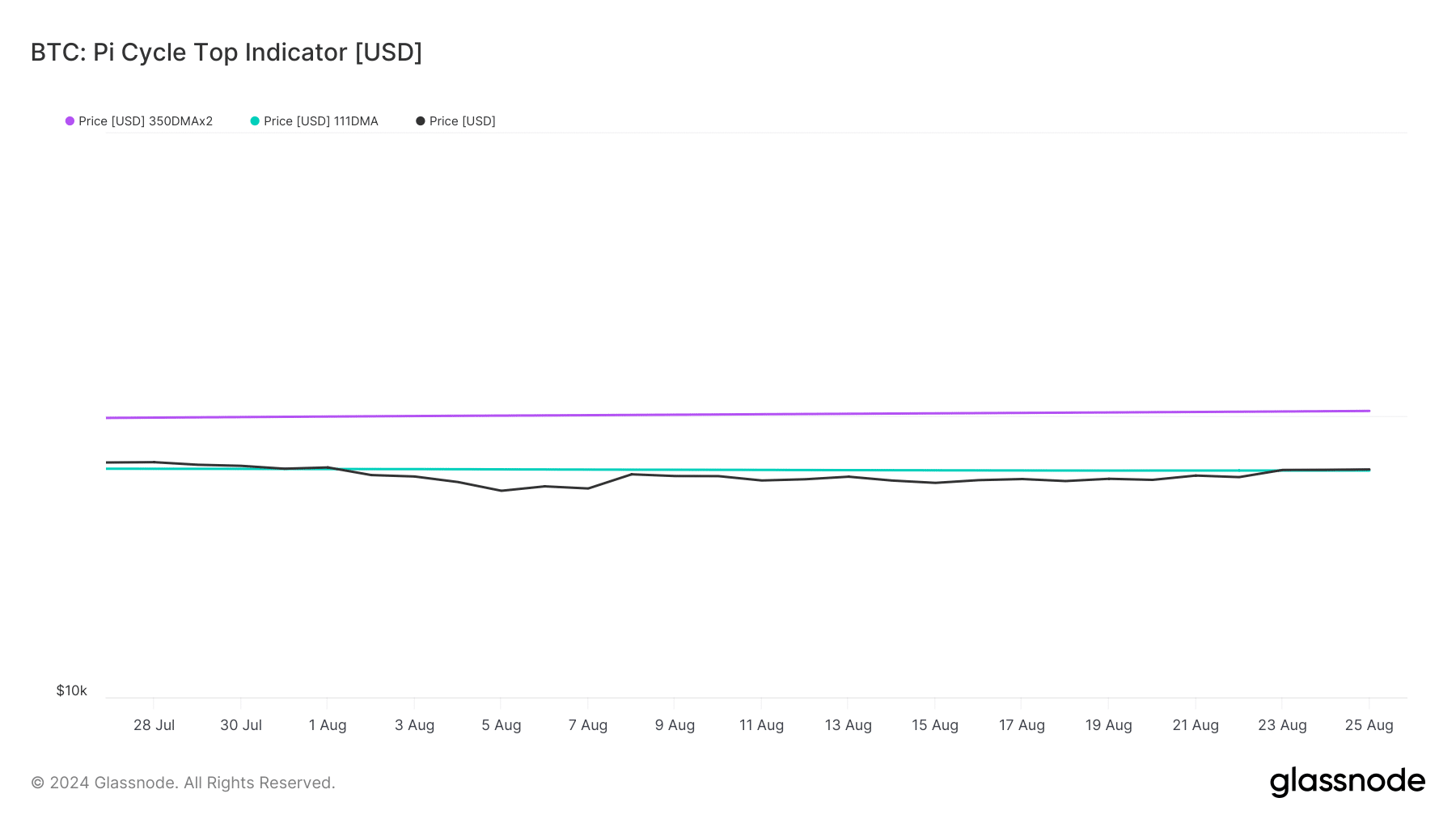

To seek out out whether or not BTC was at its market backside, AMBCrypto took a have a look at BTC’s Pi Cycle Prime indicator. As per our evaluation, BTC was sitting proper at its market backside of $63.7k.

If the indicator is to be believed, then BTC would possibly quickly begin its bull rally and attain its attainable market prime of $102k within the coming weeks or months.

We then checked different metrics to learn how seemingly it’s for Bitcoin to start a contemporary bull rally. Our evaluation of CryptoQuant’s knowledge revealed that BTC’s Coinbase premium was inexperienced.

This meant that purchasing sentiment was robust amongst US traders.

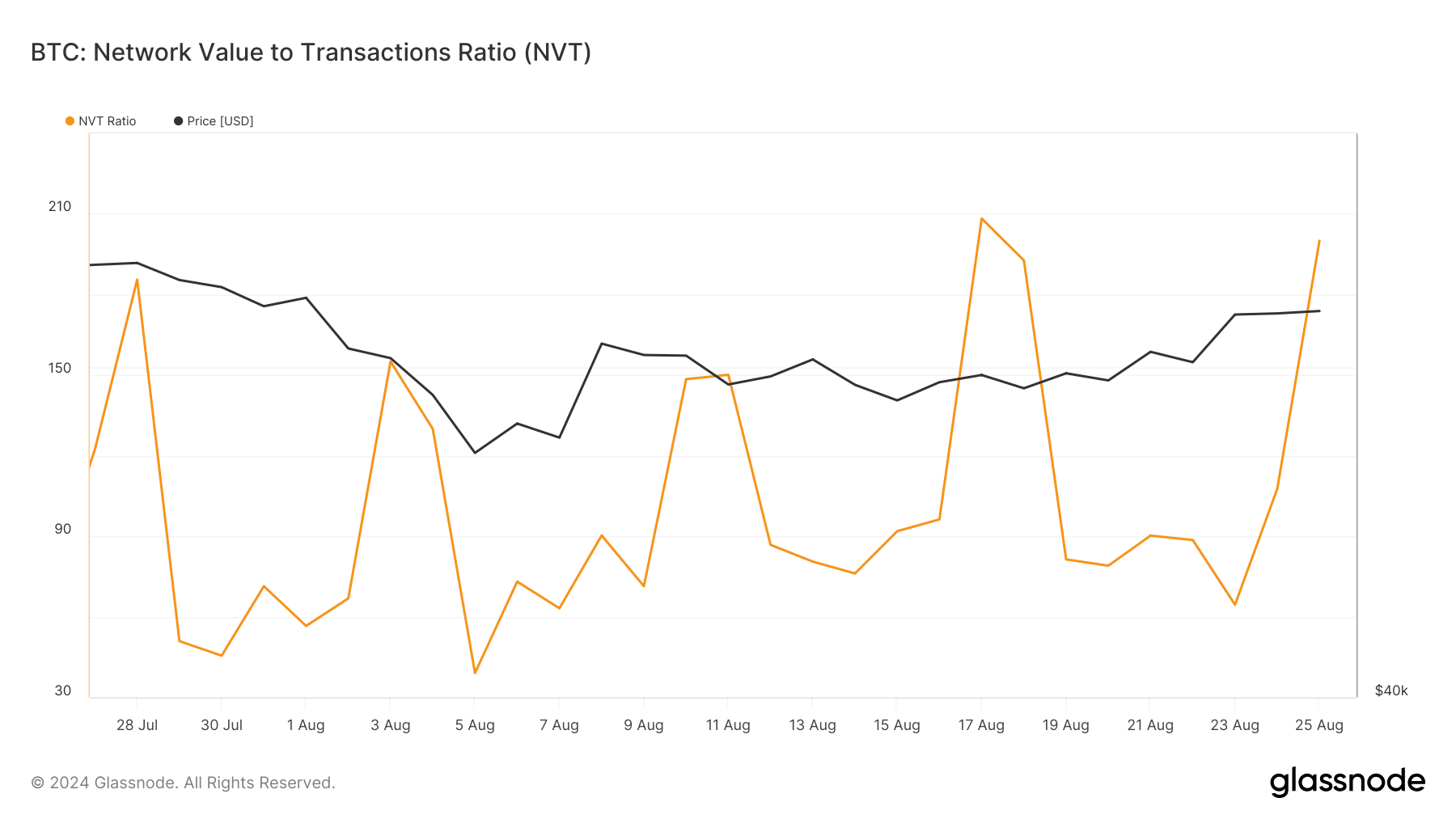

BTC’s web deposit on exchanges was additionally low in comparison with the final seven-day common, signaling an increase in shopping for strain. Nonetheless, the king of cryptos’ NVT ratio registered a pointy uptick.

Typically, an increase within the metric implies that an asset is overvalued, suggesting a value correction.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

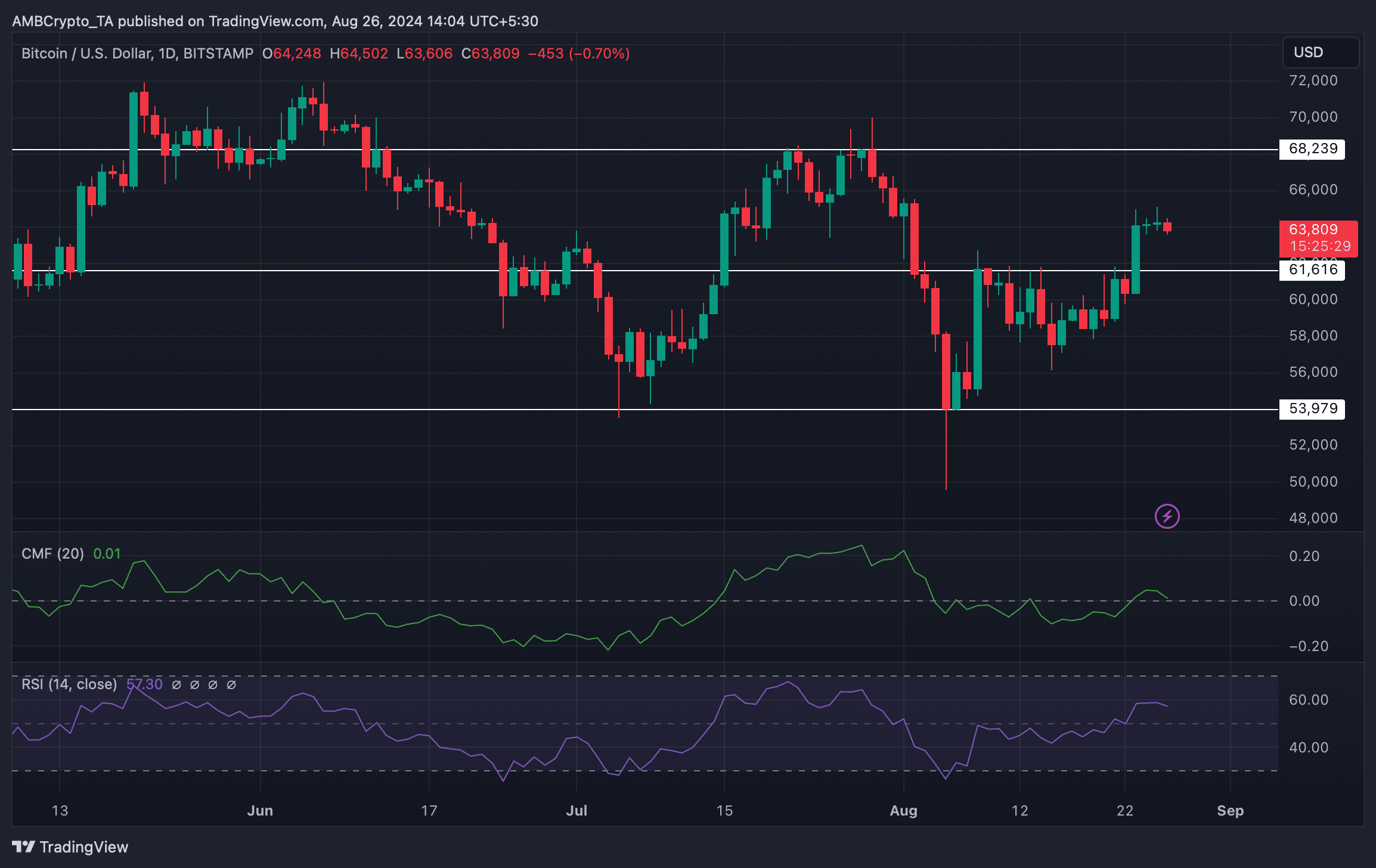

Just like the aforementioned metrics, market indicators additionally regarded fairly bearish on BTC. For instance, the Chaikin Cash Circulation (CMF) registered a downtick. The Relative Energy Index (RSI) additionally adopted an identical path.

These indicated that traders would possibly witness BTC’s value to say no within the short-term earlier than it regains bullish momentum.