What Is Trading Quantity?

Trading quantity refers back to the variety of choices contracts patrons and sellers are exchanging throughout any given interval, normally a buying and selling day. It’s monitored for particular person securities and could be summarized for shares, sectors or total markets as effectively. Trading quantity for choices is calculated by totaling the variety of contracts that transact inside a particular interval. For instance, if 5 traders collectively purchase 2,000 of a particular put possibility contract that has the identical strike worth and expiration date, then the buying and selling quantity for that contract that day is 2,000. Be part of our choices buying and selling service to study extra.

Why Trading Quantity issues?

Whether or not an possibility is purchased or offered, whether or not it’s a name or a put, when it trades on the trade, it’s thought-about quantity. Briefly, possibility quantity is the variety of contracts traded in a safety or a complete market throughout a particular time-frame, normally one buying and selling day. It’s merely the quantity of choices that change palms from sellers to patrons as a measure of exercise. If a purchaser purchases 100 contracts from a vendor or a market maker, then the quantity for that interval will increase by 100 contracts based mostly on that transaction.

Let us take a look at one other instance. Say Jim buys 100 requires XYZ Inc. (XYZ) on the October 30 strike. On the identical day, Invoice buys 200 calls for a similar strike and month. Complete quantity for XYZ’s October 30 strike would then equal 300 contracts (100 calls + 200 calls = 300). This end result would maintain true no matter whether or not the XYZ calls have been purchased or offered by both Jim or Invoice. As you possibly can see, possibility quantity signifies the variety of contracts traded at a selected strike for a selected possibility for a specified time-frame.

Possibility quantity is a useful gizmo for merchants, as it could possibly level out the place merchants are focusing their consideration on an intraday foundation. For example, assume that XYZ Inc. reported robust earnings previous to the market open and opened increased when buying and selling started. Excessive name possibility quantity could possibly be the results of such an incidence, as choices merchants attempt to make the most of the underlying inventory’s transfer increased. Vice versa, a adverse response to the identical report might carry a few spike in put possibility quantity. Nevertheless, should you didn’t know that XYZ Inc. reported earnings, however noticed the heavy possibility quantity altering palms on the inventory, you’d know that choices gamers have been speculating on some occasion or transfer within the shares. As such, possibility quantity could be an helpful indicator for occasions (recognized or unknown) surrounding a selected inventory.

What Is Open Curiosity?

Open curiosity measures the entire variety of open contracts for any particular possibility. That features all lengthy positions held by traders which have been opened however haven’t but been exercised, closed out, or expired. Open curiosity is tallied for every possibility (places separate from calls) and could be summarized by possibility kind, expiration, trade, or for the whole listed possibility market. Open curiosity is up to date every night time from all transactions, and posted for the following day. Thus, it doesn’t change throughout the buying and selling day.

Open curiosity will rise after an possibility begins buying and selling as traders tackle new positions. It’ll then both rise or decline on any given day on account of new positions, positions closed, or choices exercised the day prior to this.

Open Curiosity Instance

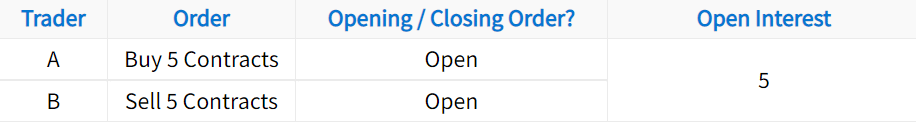

Contemplate the next commerce orders which might be routed by two completely different merchants, however on the identical possibility contract:

Right here, Dealer A is buying-to-open 5 contracts to open and Dealer B is selling-to-open 5 contracts. Each of those easy buying and selling methods are new positions.

If each merchants are stuffed on their orders, the choice’s open curiosity will improve by 5 as a result of two merchants have opened positions in that contract.

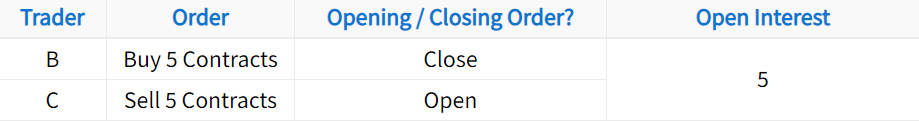

What occurs when one of many merchants closes their place whereas one other dealer opens a place? Contemplate the next trades:

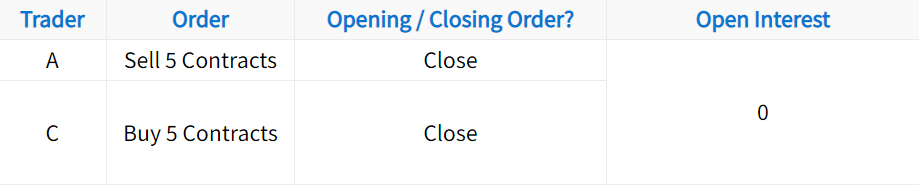

As we are able to see right here, Dealer B purchased 5 contracts to shut whereas Dealer C offered 5 contracts to open. On this case, open curiosity stays at 5 as a result of there are nonetheless 5 contracts open between Dealer A and C. Nevertheless, if Dealer A sells 5 contracts to shut and Dealer C buys 5 contracts to shut, open curiosity will lower by 5:

So, open curiosity represents the variety of possibility contracts which might be open out there between two events, although you don’t have to be involved in regards to the particular events.

Why Open Curiosity Issues

When you’re wanting on the whole open curiosity of an possibility, there is no such thing as a method of realizing whether or not the choices have been purchased or offered. That is in all probability why many choices merchants ignore open curiosity altogether. Nevertheless, you should not assume that there is not any vital data there.

A technique to make use of open curiosity is to take a look at it relative to the quantity of contracts traded. When the quantity exceeds the prevailing open curiosity on a given day, it means that buying and selling in that possibility was exceptionally excessive that day.

Open curiosity additionally offers you key data concerning the liquidity of an possibility. If there is no such thing as a open curiosity in an possibility, there is no such thing as a secondary market for that possibility. When choices have a major open curiosity, it means there are a lot of patrons and sellers on the market. An lively secondary market will increase the chances of getting possibility orders stuffed at good costs.

All different issues being equal, the larger the open curiosity, the simpler will probably be to commerce that possibility at an affordable unfold between the bid and ask.

For instance, suppose you have a look at choices on Apple Inc. and see the open curiosity is 12,000. This implies that the market in Apple choices is lively and there could also be lots of traders within the market who wish to commerce. The bid worth of the choice is $1 and the supply worth of the choice is $1.05. Subsequently, it’s seemingly you should buy one name possibility contract on the mid-market worth.

However, suppose the open curiosity is 1. This means there’s little or no open curiosity in these name choices and there’s no secondary market as a result of there are only a few patrons and sellers. It could be tough to enter and exit these choices at good costs.

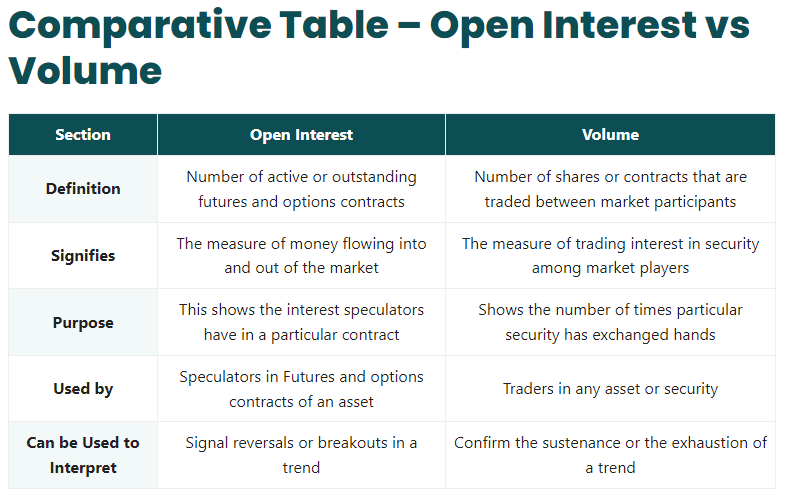

Picture by wallstreetmojo.com.

The Significance of Possibility Liquidity

An possibility’s quantity and open curiosity are crucial to you as an choices dealer as a result of you do not need to get caught buying and selling illiquid choices (low quantity and low open curiosity). Illiquid choices are likely to have large bid-ask spreads , which might have a major influence in your buying and selling account. It is going to be harder to get the value you’re searching for, thereby forcing you to simply accept a lower cost for a sale or pay the next worth for a purchase order than you may want. Moreover, in case your order for an possibility doesn’t get executed in a well timed trend, the underlying inventory may transfer in worth, altering the parameters of your supposed technique. Energetic possibility merchants view liquidity as an important standards in deciding on and executing their methods.

Moreover, it’s more durable to get out of possibility positions at good costs when quantity and open curiosity are low, which suggests losses might develop bigger as a result of incapability to exit a place.

What are splendid ranges of quantity and open curiosity? On the naked minimal, the choices you employ on your positions ought to have quantity within the a whole bunch and open curiosity within the hundreds:

- Minimal Every day Quantity: 100s, ideally 1,000s.

- Minimal Open Curiosity: 1,000s.

At this level, you perceive the fundamentals of quantity and open curiosity, and why they’re vital to you as an choices dealer. Within the subsequent part, we’ll go over which choices on a inventory are likely to have probably the most of every.

Potential Trading Indicators

Right here’s an summary of some potential quantity and open curiosity buying and selling alerts to be careful for:

-

If costs are rising and name contract open curiosity can be rising, it could possibly be a bullish sign that patrons are establishing new lengthy positions.

-

If costs are rising however name contract open curiosity is falling, it could possibly be a bearish sign that merchants are shedding conviction within the bullish pattern.

-

If costs are falling however open curiosity in put contracts is rising, it could possibly be a bearish sign that merchants are opening new brief positions.

- If costs are falling however name contract open curiosity can be falling, name holders could also be getting compelled out of their positions by margin calls, which could possibly be a bearish short-term indicator but additionally a sign {that a} backside could possibly be close to.

Backside Line

Choices buying and selling quantity and open curiosity are metrics that assist traders higher perceive and interpret market motion in each the choices themselves and of their underlying shares. Additionally they present a gauge on how liquid an choices contract is and the way simply will probably be to favorably open or shut a place in it. Whereas each metrics have limitations, when mixed with different knowledge, they assist traders perceive choices liquidity higher and make higher knowledgeable buying and selling selections.

Subscribe to SteadyOptions now and expertise the complete energy of choices buying and selling at your fingertips. Click on the button under to get began!