- Over 92% of Bitcoin traders have been in revenue because it crossed $66k on the charts

- A sustained rally may push BTC to an ATH

Bitcoin [BTC] has been comfortably shifting north these days, with the cryptocurrency managing to climb above $66k once more. Now, whereas this pointed to an optimistic flip for the king coin, the market would possibly quickly take a U flip within the coming days.

This might be the case, particularly as a multi-year bearish sample appeared on BTC’s chart.

Bitcoin sees hazard forward

AMBCrypto reported beforehand that the cryptocurrency had crossed its long-term shifting common, breaking key resistance ranges. Because of that, BTC’s worth rallied above $66k on the charts.

After it crossed $66k, greater than 49 million BTC addresses have been in revenue, which accounted for over 92% of the full variety of BTC addresses.

Nonetheless, the bull rally would possibly finish quickly. Ash Crypto, a preferred crypto analyst, lately shared a tweet highlighting a multi-year bearish head and shoulder sample on BTC’s chart.

The sample emerged in 2021, and at press time, the coin’s worth was approaching the neckline help of the identical sample. As per the tweet, a failed take a look at of the help may end in a large crash.

Is BTC awaiting a correction?

Since there may be some chance of a crash, AMBCrypto checked BTC’s metrics to seek out the chances of BTC dropping to its neckline help stage.

As per our evaluation of CryptoQuant’s information, BTC’s web deposit on exchanges was excessive, in comparison with the final seven days’ common. This underlined a hike in promoting strain. Every time promoting strain rises, it usually leads to worth corrections.

The coin’s aSORP turned crimson, suggesting that extra traders have been promoting at a revenue. In the course of a bull market, it may point out a market prime. Its NULP additionally seemed bearish. All of those metrics clearly indicated that the probabilities of BTC worth correction have been excessive.

Nonetheless, not all the pieces turned in opposition to BTC. AMBCrypto’s take a look at Glassnode’s information revealed an optimistic metric.

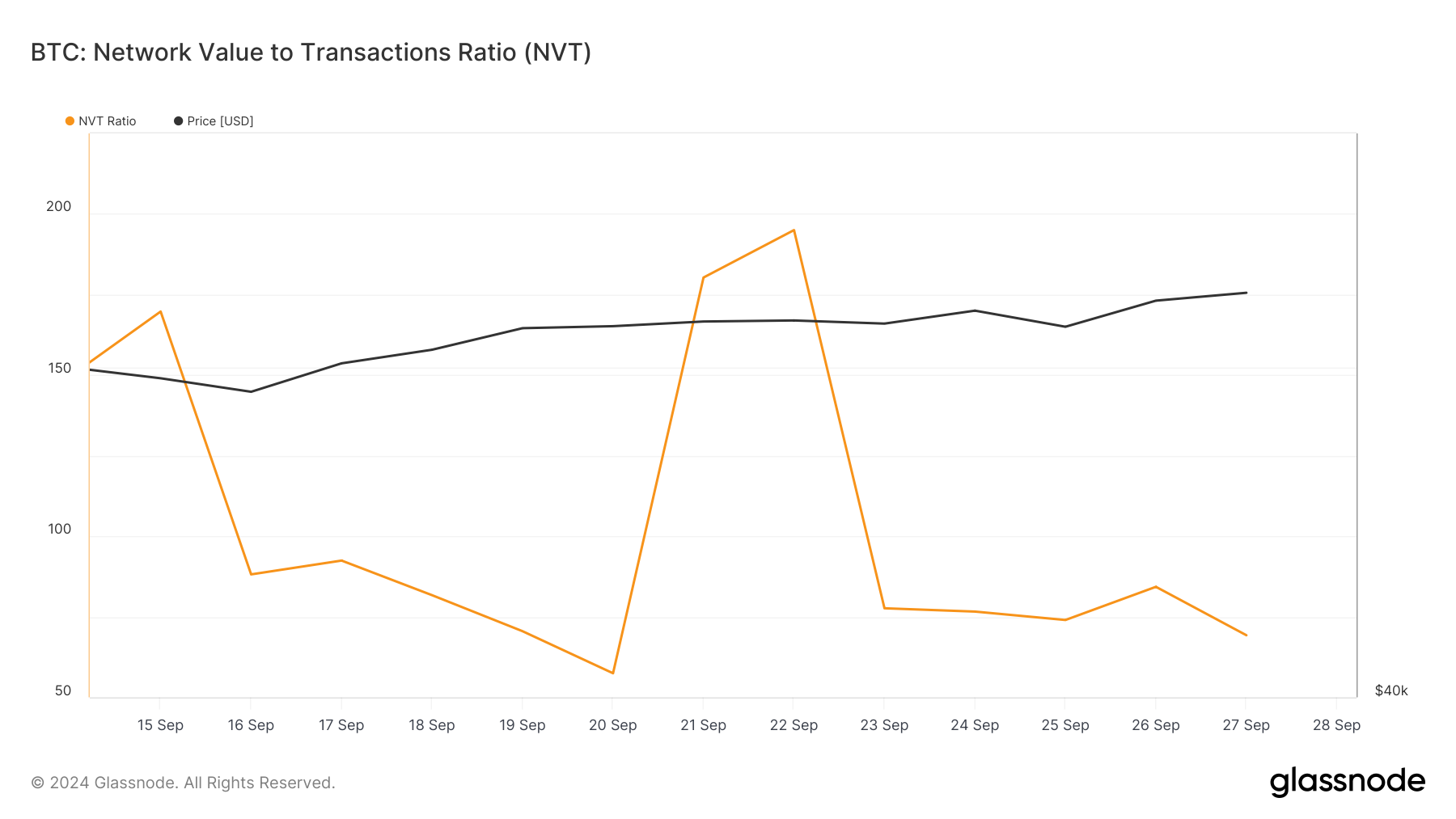

We discovered that BTC’s NVT ratio was dropping. A decline within the metric signifies that an asset is undervalued, hinting at a worth hike within the coming days.

We then checked Bitcoin’s weekly chart to seek out out the place it would go if the uptrend continues, as instructed by the NVT ratio. As per our evaluation, a sustained bull rally may push BTC in the direction of its all-time excessive as soon as once more.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

If issues fall in place, then the coin would possibly as properly attain a brand new ATH. Nonetheless, if a worth correction occurs, then BTC would possibly once more fall to $54k within the coming weeks.