- Open BTC Futures on Binance jumped from 85K BTC to 90K this week.

- BTC volatility is anticipated forward of essential US inflation information and CZ’s jail launch.

Binance [BNB] alternate has recorded a spike in Bitcoin [BTC] Futures open contracts forward of key U.S. financial information and crypto-specific occasions.

The alternate noticed an almost 7% enhance in Open Curiosity (OI) on the twenty third of September. This tipped BTC Futures to leap from round 85K cash to 90K on the time of writing.

Notably, former Binance CEO Changpeng Zhao (CZ) can be launched from jail on the twenty ninth of September.

This meant speculators, particularly on the Binance alternate, took further dangers to guess on BTC. Maybe they had been satisfied of a possible BTC worth rally forward of the US PCE Index (Value Consumption Expenditure) information.

Speculators’ BTC urge for food surge

Market pundits are awaiting PCE information to gauge the potential tempo of the Fed’s curiosity cuts sooner or later. So, BTC may react to the info.

Some market observers view this occasion as a possible catalyst for BTC worth volatility. Briefly, the time between the twenty seventh to twenty ninth of September may see wild volatility for the most important cryptocurrency.

The sharp uptick in OI denotes elevated market curiosity. By extension, it additionally underscores the bullish outlook of Futures market speculators.

Nonetheless, it additionally exposes speculators to the chance of huge liquidations, which could induce additional volatility and worth swings for BTC.

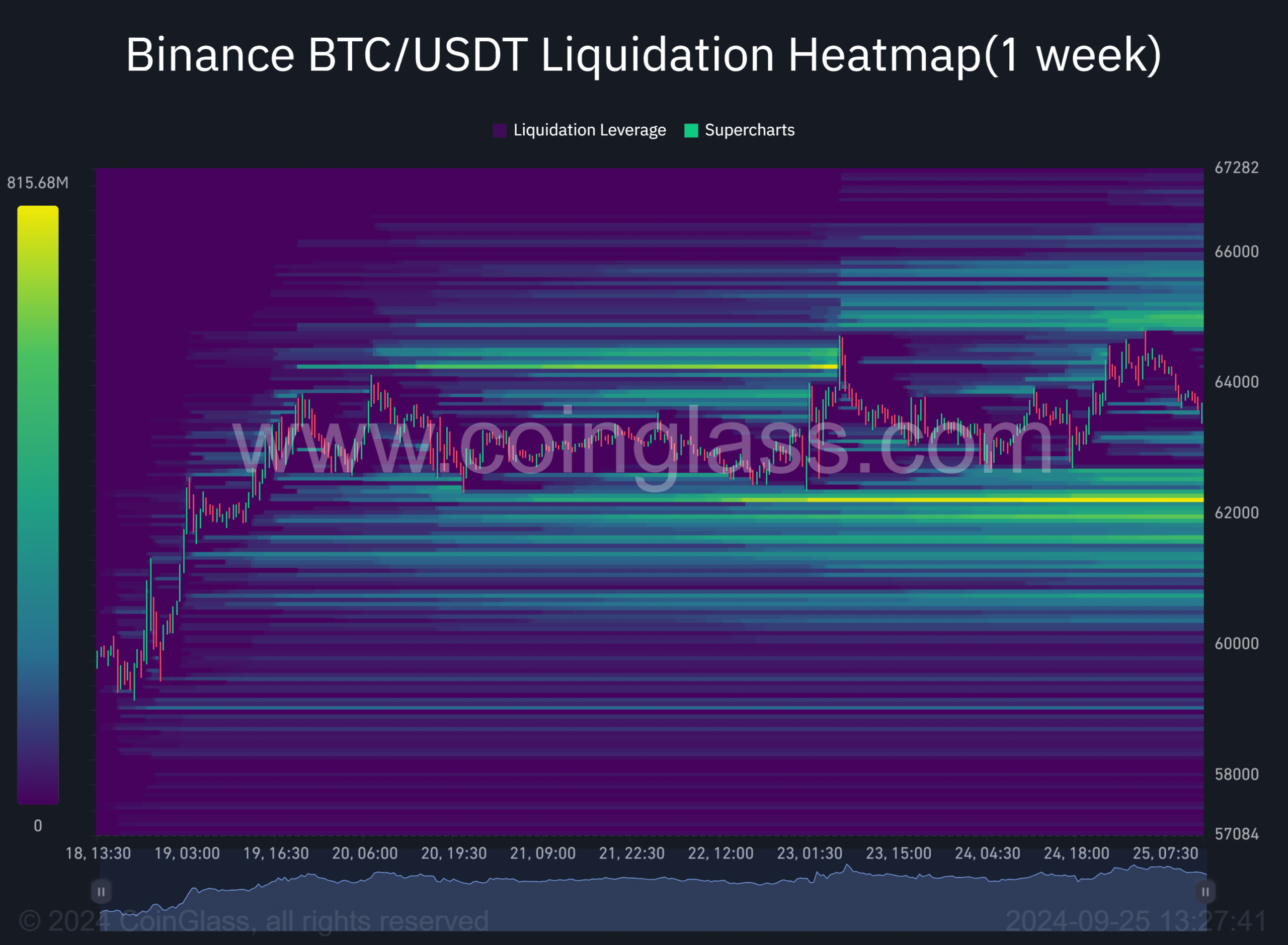

Per Coinglass’s 1-week liquidation map, key ranges to look at had been at $62K and $65K. Quick positions had been build up close to $65K.

Moreover, there have been additionally vital lengthy positions at $62K (as proven by the brilliant orange colour).

A pointy blast above $65K may liquidate a number of quick bets on the degree, exposing bears to huge losses. Equally, a wild retest of $62.2K space may attain over $800 million price of lengthy positions.

Bitcoin worth motion

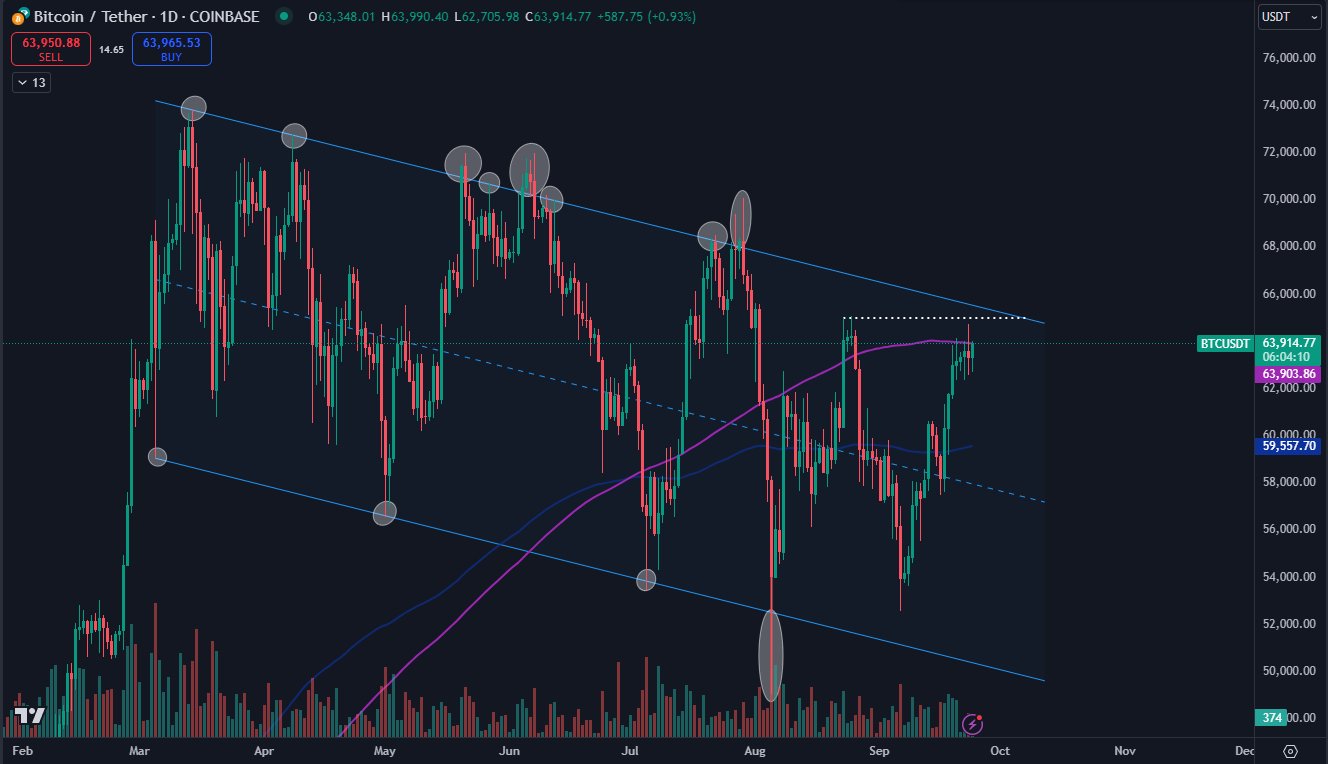

Bitcoin’s worth remained beneath $64,000, and it did not surpass the essential 200-day MA (Transferring Common). The 200-day MA stood at $63.9K, at press time.

Per dealer Daan Crypto, a powerful transfer above the extent and channel may mark a bullish market construction shift. This might speed up BTC in the direction of its ATH.

That stated, such an upside transfer may set off a brief squeeze and expose bears to losses. It stays to be seen if these catalysts may tip BTC to clear its overhead hurdle at $65K.