- Ethereum staking noticed constant progress this yr, with over 54 million ETH at stake

- Technical indicators revealed the potential of a value hike quickly

Ethereum [ETH] staking has been constantly up in 2024, reflecting traders’ belief within the king of altcoins. A hike in Ethereum staking implies that extra Ether tokens are being dedicated to the Ethereum community to validate transactions and preserve safety.

Nonetheless, will this have a constructive influence on the token’s value within the remaining days of 2024?

Will staking assist Ethereum?

IntoTheBlock, a well-liked information analytics platform, lately shared a tweet, revealing that Ethereum staking noticed constant progress this yr, with over 54 million ETH staked. The market additionally noticed the explosive progress of ETH restaking, which at the moment accounts for almost 10% of staked ETH.

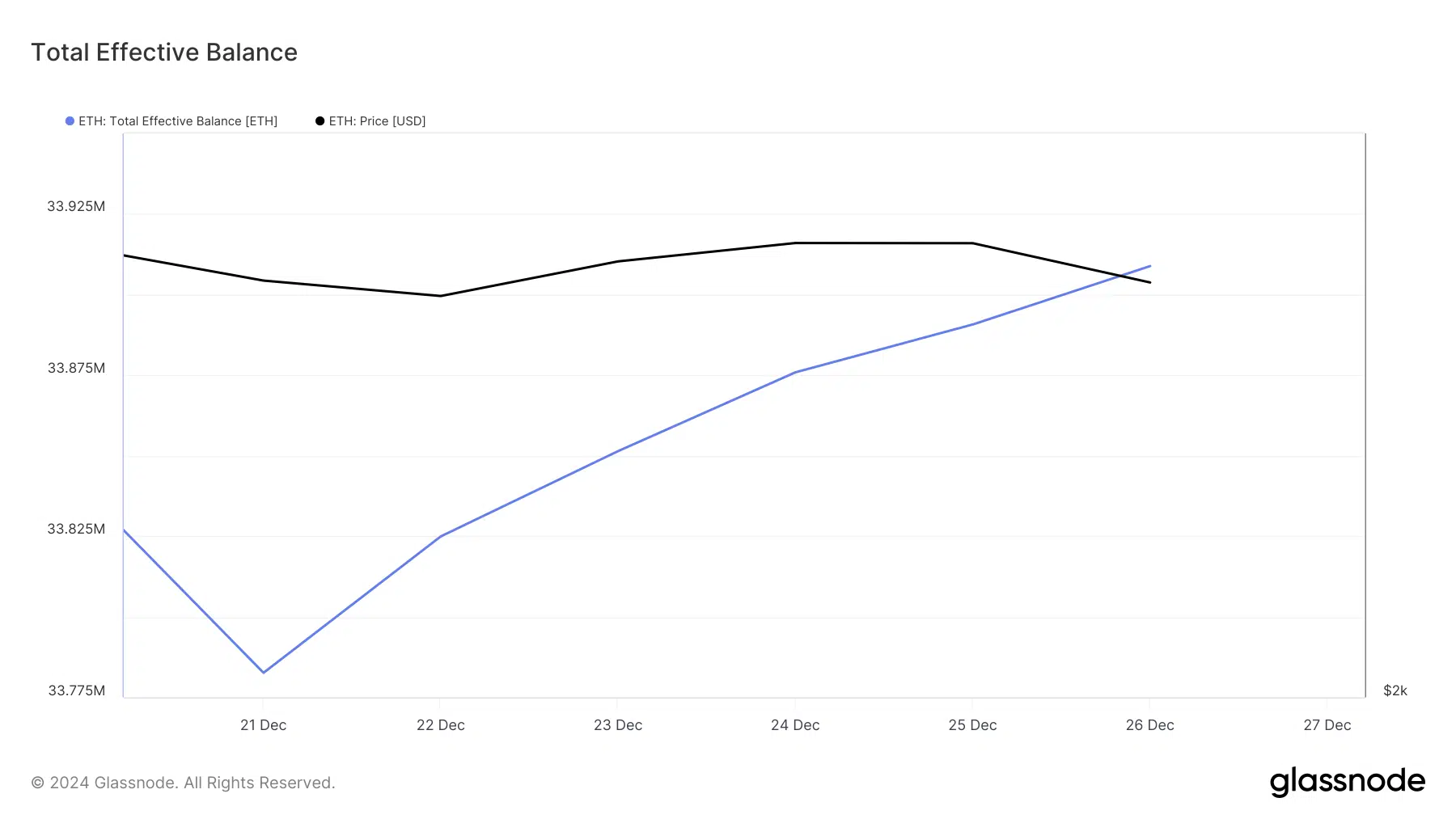

In reality, AMBCrypto’s evaluation of Glassnode’s information revealed that associated datasets additionally moved up within the final seven days. As an example, Ethereum’s complete efficient steadiness shot up. The entire staked steadiness is that which is actively collaborating in Proof-of-Stake consensus.

What’s taking place with ETH’s value?

Whereas all this occurred, ETH’s value was considerably consolidating. On the time of writing, the token’s day by day and weekly charts remained purple. Ethereum was buying and selling at $3.38k with a market capitalization of over $406 billion.

CryptoQuant’s information revealed that ETH’s alternate reserve has been dropping, that means that purchasing strain on the token was excessive. Nonetheless, regardless of declining alternate reserves, the blockchain’s lively addresses and switch quantity declined within the current previous.

Nonetheless, Ethereum’s funding charge has been rising. Within the crypto market, a rise in funding charges can imply that merchants are optimistic concerning the market and anticipate the value to rise. This may additionally imply that the market is overheated. Funding charges can enhance market volatility, inflicting value adjustments to be extra dramatic.

Subsequently, AMBCrypto checked the token’s day by day chart to search out out extra about which approach the token could also be heading. As per our evaluation, ETH’s value had already touched and rebounded from the decrease restrict of the Bollinger Bands.

Each time that occurs, it hints at a value hike. Moreover, the Relative Power Index (RSI) additionally registered a slight uptick, additional suggesting a value hike within the coming days. If that occurs, then ETH would possibly first check its resistance on the 20-day SMA.

Learn Ethereum’s [ETH] Value Prediction 2024-25

A profitable breakout could lead on the altcoin to $4k as soon as once more. Nonetheless, a failed check can pull the token right down to $3k.