- A majority of traders need to spend money on Bitcoin NFTs over their Ethereum counterparts.

- Ethereum is predicted to hike within the subsequent few weeks, due to alternate outflows.

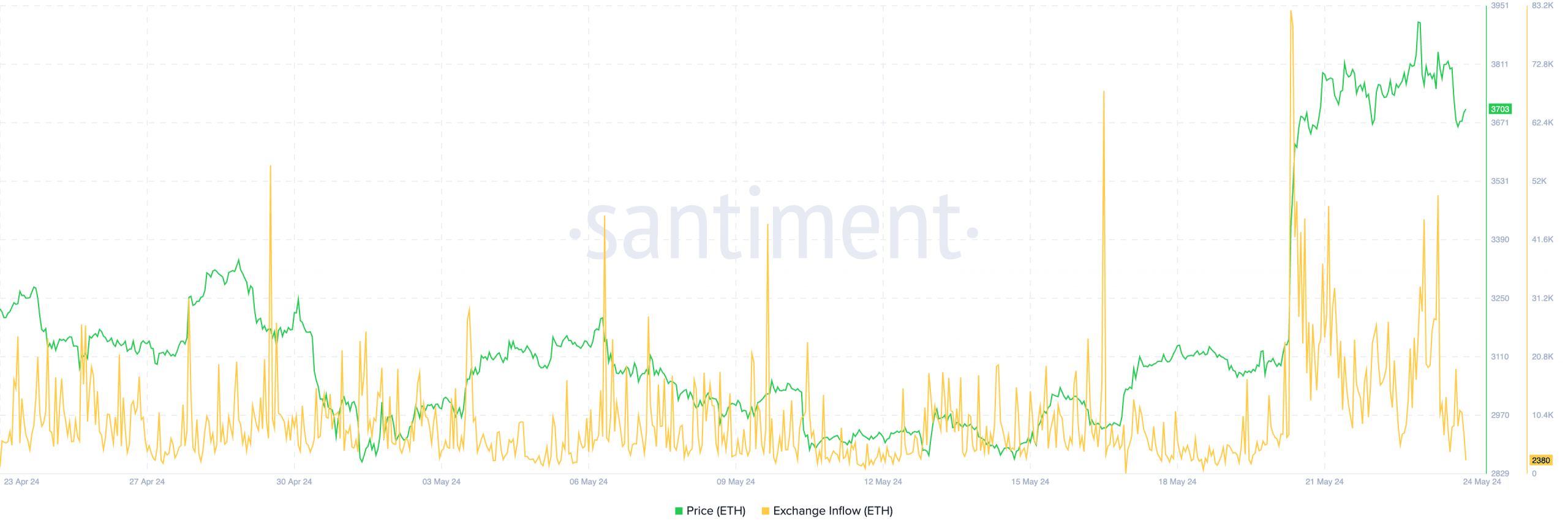

The crypto market noticed Spot Ether ETFs approval on 23 Could. Traders, at massive, had been anticipating a brief rally after this much-awaited occasion. Nevertheless, ETH as a substitute declined by as a lot as 4% in simply 24 hours and Bitcoin mirrored its transfer.

Now, analysts are divided on predicting Bitcoin’s subsequent degree, with some anticipating a significant correction whereas others are forecasting an arrival of a bull rally.

In actual fact, an unique survey carried out by AMBCrypto discovered that 67.3% of traders expect the king coin to rise by 80% by the top of this yr.

As per our evaluation, Bitcoin is making ready for a significant bull run forward. AMBCrypto’s report – Could 2024 discusses the highest 4 the reason why the market ought to anticipate a bullish transfer quickly.

Stunning findings from AMBCrypto’s survey

To gauge market sentiment intently, we reached out to greater than 550 crypto customers from throughout the globe. Our evaluation discovered that traders are getting extra considering buying memecoins, when in comparison with Bitcoin.

As an example, 53.7% of respondents stated they’d select memecoins over Bitcoin of their portfolios.

A lot to our shock, near 60% of market contributors additionally revealed that they need to spend money on Bitcoin NFTs over Ethereum NFTs. This goes on to spotlight the rising demand for Bitcoin’s layer 2 options.

AMBCrypto’s Crypto Market Report – Could 2024 version dives deep into the findings of the survey with many unique insights for merchants and traders.

Layer 3 dominates conversations in Could

In accordance with AMBCrypto’s evaluation, Layer 3 has been the fastest-moving narrative over the past month. It has the potential to occupy a bigger market share within the coming months.

The report discovered that its adoption within the East has been excessive, when in comparison with the West. Primarily as a result of international locations just like the U.S. and the UK are majorly targeted on the use circumstances of Layer 2 options at the moment. So, a significant progress alternative is awaiting Layer 3 tasks.

Now, if Layer 3 adoption accelerates, the Ethereum blockchain is prone to profit essentially the most from it. AMBCrypto’s Could report explains the explanations intimately.

So far as Ethereum is anxious, its alternate inflows have fallen considerably after 21 Could. A value hike, therefore, can certainly be anticipated.

Check out AMBCrypto’s Report – Could 2024 Version

This report reveals the fastest-moving crypto narratives, stunning information units, and unique insights. It should dive into key matters like –

- Bitcoin’s June Outlook and what to anticipate going ahead

- The rising affect of Layer 3, and the way it can change the Net 3 panorama

- The dominance of SocialFi tasks and why are they trending

- A have a look at main altcoins and what their future trajectory may seem like

- Ethereum’s weakening correlation with the king coin

- NFT market’s falling quantity – Is there any probability of revival?

You may also obtain the complete report right here.