- Bitcoin might begin October on a bullish observe, supported by a hidden sample.

- The chance leans strongly in favor of this state of affairs.

Bitcoin [BTC] had a bullish weekend, briefly testing the $60K mark earlier than pulling again. At press time, it traded at $58,272, reflecting a momentary retreat after the surge.

With costs retracing, hope hinges on the upcoming Fed fee minimize—nevertheless it’s not the one issue. As BTC enters its 148th day post-halving, a hidden sample suggests the breakout could also be nearer than anticipated.

Historical past suggests rebound chance

The chart highlights a recurring development within the Bitcoin cycle rising after every halving season. For context, Bitcoin halving is a deflationary mannequin occurring each 4 years, decreasing the Bitcoin provide by half.

From an financial standpoint, a decreased provide will increase the worth of every coin. Consequently, every cycle sometimes sees an upward development start after a median of 170 days.

As an example, following the halving on eleventh Could, 4 years in the past, BTC first examined the $40K ceiling on the each day worth chart roughly 170 days later. A extra important peak pushed BTC above $50K roughly 480 days after, round early August.

An identical sample has been noticed after every halving interval. If this development holds, BTC would possibly attain $70K within the first week of October earlier than going through resistance. Moreover, the upcoming FOMC assembly might additional affect this speculation.

Though the historic development seems to be promising, actuality should be factored in—so, is a possible rebound simply 23 days away?

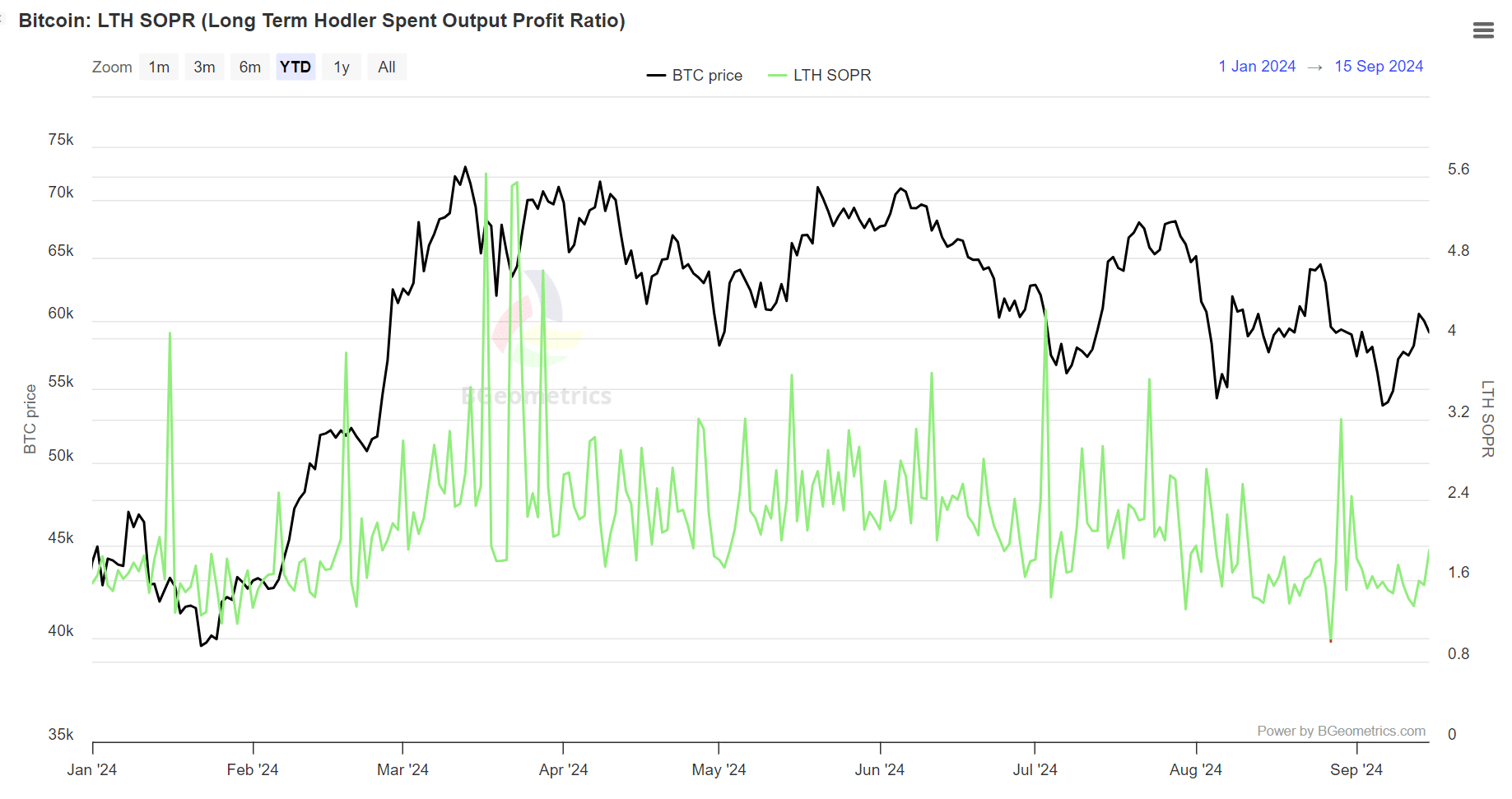

LTH bolstered their assist for Bitcoin

Seasoned buyers are assured in a possible worth correction. Traditionally, a rising LTH SOPR helps every bull rally, indicating long-term holders are realizing income.

Whereas the uptick is an indication of optimism, if the worth doesn’t match the rise, it might undermine the anticipated correction. This will likely immediate long-term holders to promote at a revenue slightly than threat losses.

Put merely, long-term holders realizing income alerts energy in Bitcoin’s present market worth. If this development persists, a reversal might be imminent. Nevertheless, a worth retrace beneath $57K would possibly sign concern.

The LTHs characterize a good portion of buyers, however they alone don’t totally seize market confidence in an October upward development.

That mentioned, analyzing futures merchants can present higher insights.

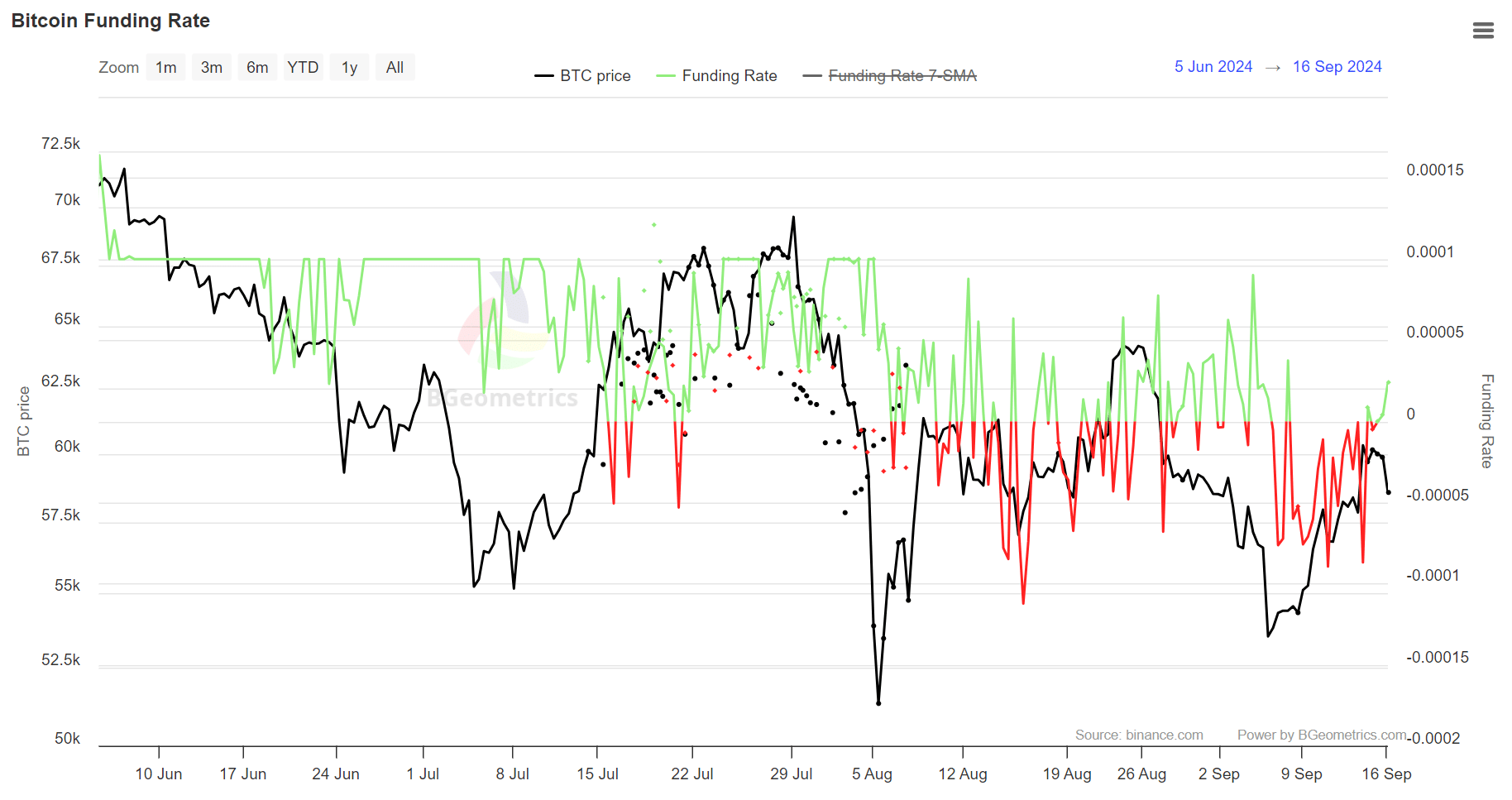

Renewed confidence amongst Bitcoin future merchants

Whereas shorts have dominated derivatives for some time, longs have not too long ago elevated their presence, as proven by the optimistic funding fee. Traditionally, a optimistic funding fee signifies confidence amongst futures merchants, suggesting they anticipate BTC costs to rise.

Furthermore, this aligns with AMBCrypto’s earlier projections, which famous {that a} optimistic sentiment typically precedes BTC testing essential worth ranges.

Although appreciated, a extra constantly optimistic funding fee might enhance the probabilities of a Bitcoin rebound within the subsequent two weeks.

Surprisingly, regardless of renewed dominance, BTC fell beneath $60K, suggesting potential third-party involvement.

Whereas this means a slight divergence, different elements might neutralize its long-term influence. The query stays: Will the downtrend maintain?

What now?

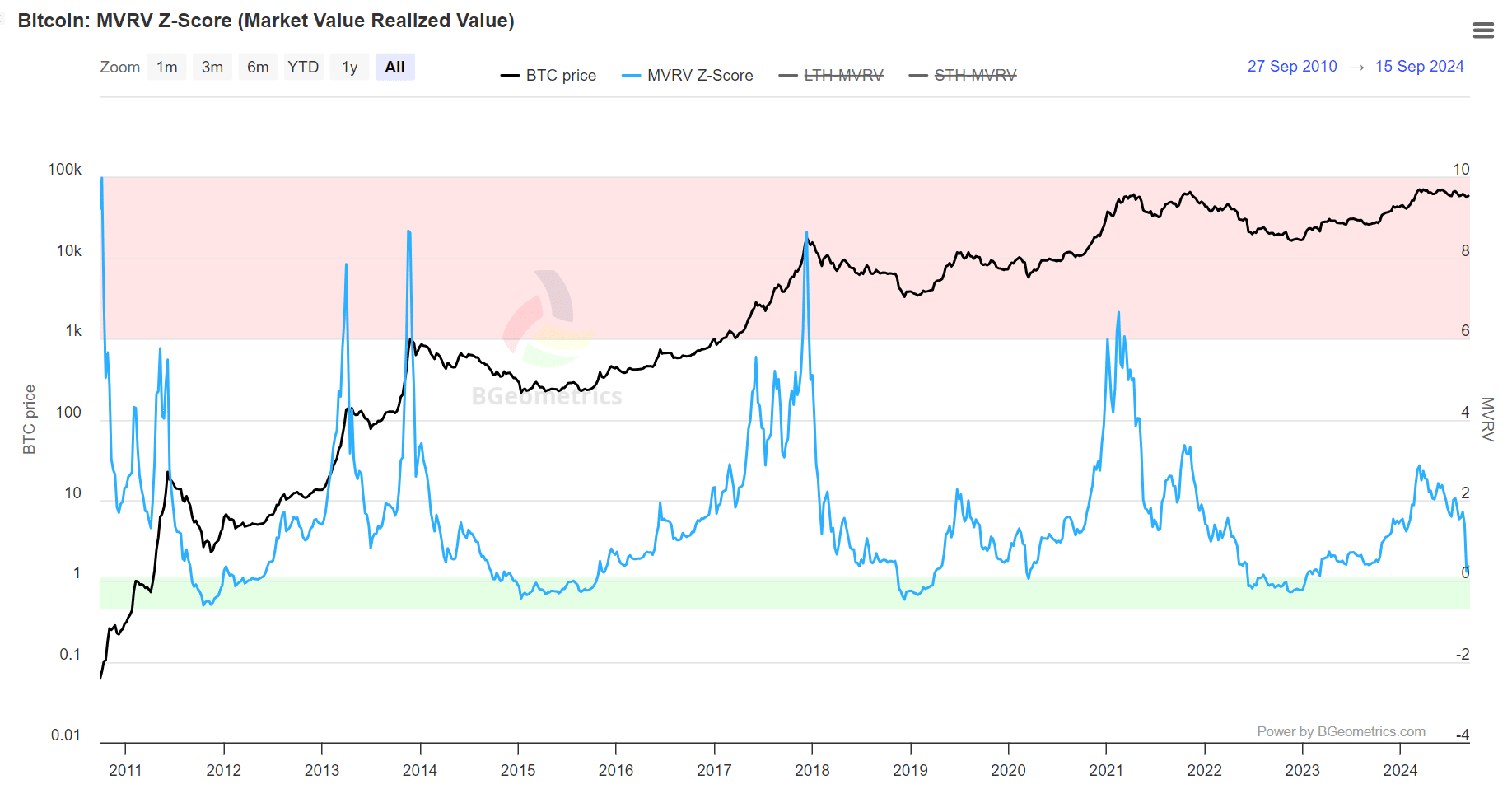

The chart beneath reveals the MVRV-Z rating approaching the inexperienced field, a zone that traditionally alerts undervaluation. Shopping for Bitcoin throughout these intervals has sometimes resulted in outsized returns, with BTC costs rallying afterward.

Nevertheless, if the halving development holds true, the present MVRV mirrors the mid-September worth from 4 years in the past—simply earlier than the Z-score entered the pink field, which alerts the market cycle prime. The above talked about charts assist this state of affairs.

Learn Bitcoin (BTC) Worth Prediction 2024-25

In keeping with AMBCrypto, October might begin with Bitcoin testing the market prime round $70K, offered current profit-takers chorus from promoting, LTH continues to carry, and longs keep dominance within the perpetual market.

If this performs out, the halving impact speculation could be confirmed as “true.”