- Since September, a persistent imbalance within the buy-to-sell ratio has strengthened BTC’s bullish outlook.

- Traders are buying $80 billion value of BTC month-to-month, underscoring demand and rising confidence within the asset.

Bitcoin’s [BTC] upward pattern might persist regardless of minor retracements, as noticed within the every day time-frame. The asset lately skilled a 0.28% decline, which seems to be a pure pullback inside its broader rally.

AMBCrypto highlights this worth fluctuation as a part of BTC’s prolonged rally, which is analyzed in larger element beneath.

Brief-term holders stop main BTC worth decline

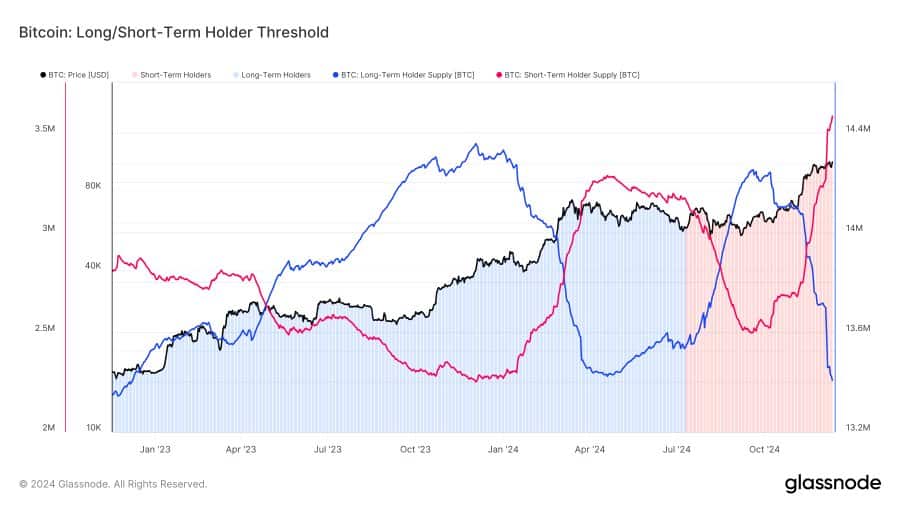

A current report from analyst James Van Straten reveals important buying and selling exercise within the BTC market since September, serving to to stabilize BTC’s worth. The Lengthy/Brief-term holder threshold presently stands at 1.28, suggesting a powerful desire for accumulation.

Because of this for each 1 BTC bought, consumers are stepping in to buy roughly 1.28 BTC, which is indicative of persistent demand.

A better evaluation reveals that long-term holders (LTH)—addresses holding BTC for over two years with out transacting—have been liable for a lot of the sell-offs. In the meantime, short-term holders (STH) or early buyers actively drove the shopping for exercise.

Between September and now, a complete of 843,113 BTC was bought, whereas 1,081,633 BTC was collected. Each day, consumers acquired 12,432 BTC, in comparison with 9,690 BTC bought.

This imbalance in favor of shopping for displays bullish market sentiment, as elevated accumulation prevents BTC from experiencing a pointy worth decline. The sustained demand has doubtless helped BTC preserve its place above the $90,000 vary following its current all-time excessive.

Historic second for BTC

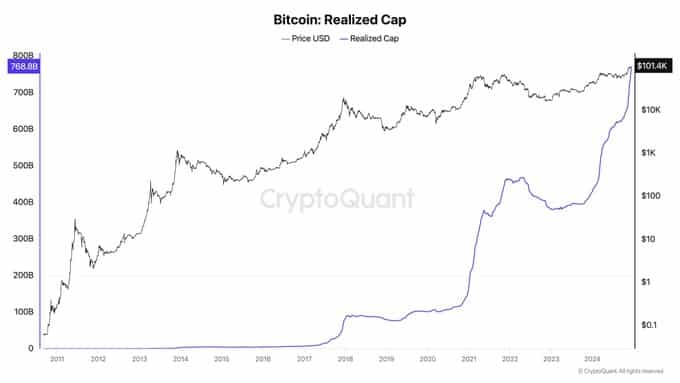

Based on analyst Ki Younger Ju, Bitcoin has seen a major inflow of funds, with shopping for exercise reaching $80 billion per 30 days.

This growth is a extremely bullish indicator for BTC, suggesting that adoption is steadily growing. Extra retail buyers are getting into the market, buying BTC in larger portions than ever earlier than.

Ki Younger Ju highlighted this momentum, stating:

“Nearly half of the capital that has entered the Bitcoin market over the past 15 years was added this year.”

If this pattern continues, BTC’s long-term outlook stays robust, positioning the asset for sustained upward motion.

AMBCrypto additionally analyzed BTC’s speedy market exercise to evaluate its short-term outlook.

BTC maintains bullish momentum

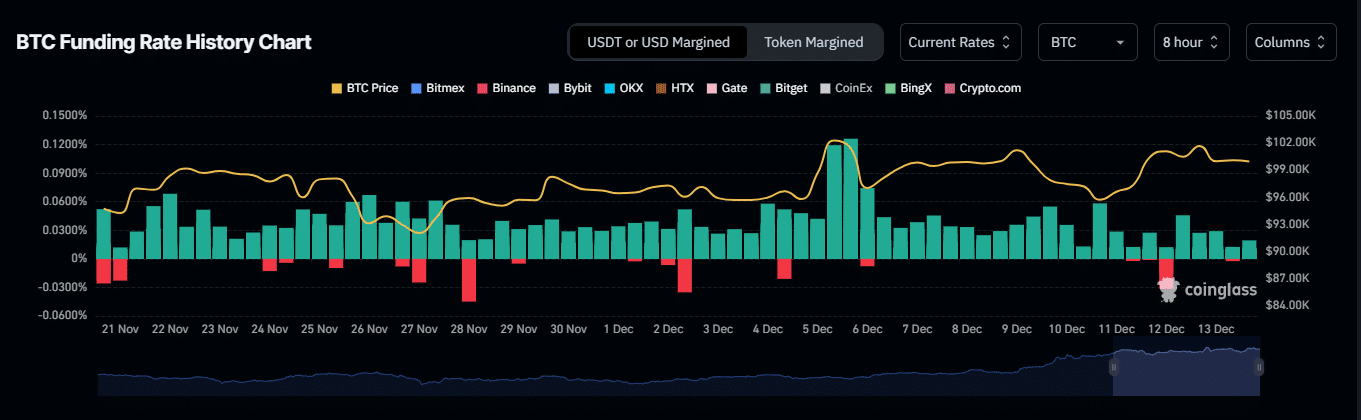

Regardless of a 0.28% dip in BTC’s worth over the previous 24 hours, market indicators proceed to sign a bullish outlook.

As of this writing, BTC’s funding price stays constructive at 0.0100% over the past eight hours, in line with information from Coinglass.

A constructive funding price means that lengthy merchants preserve worth stability in each spot and futures markets, reflecting an general bullish sentiment and creating alternatives for additional worth development.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Moreover, an evaluation of BTC’s long-to-short contract ratio reveals it stays impartial at 1. A transfer above or beneath this degree might decide the market’s subsequent directional bias.

Contemplating BTC’s long-term outlook and the constructive funding price, the present fluctuation seems to be a minor retracement, with the bulls sustaining a bonus.